Introduction

Finance teams today are under increasing pressure to deliver faster insights, support business agility, and improve risk oversight—all while managing cost and compliance. Traditional finance functions, built on manual processes and legacy systems, are ill-equipped for this new mandate. Artificial Intelligence (AI) is stepping in as a game-changer—automating core tasks, enabling predictive analytics, and elevating the finance function into a true strategic partner.

This guide explores how AI is transforming finance—from daily accounting routines to high-level financial planning—offering specific use cases, measurable benefits, and the challenges to address along the way.

What is AI and Why Does It Matter in the Finance Function?

1. Definition of AI and Its Core Technologies

1. Definition of AI and Its Core Technologies

Artificial Intelligence (AI) refers to computer systems capable of performing tasks that typically require human intelligence, including pattern recognition, learning from data, and making informed decisions. Core technologies include machine learning, natural language processing (NLP), and computer vision, all of which enable systems to continuously improve performance over time IBM.

In the finance function, AI applies these technologies to areas like invoice processing, expense classification, cash flow forecasting, and fraud detection. By extracting patterns from massive datasets and automating repetitive processes, AI helps finance teams work smarter—not harder.

Want to explore how AI can transform your sector? Discover real-world strategies for deploying smart technologies in airline systems. Visit How to Integrate AI into Your Business in 2025 to get started today and unlock the full potential of AI for your business!

2. The Growing Role of AI in Transforming Finance

AI is radically reshaping finance operations by replacing manual work with intelligent automation. Tasks like data entry, bank reconciliation, and invoice matching can now be completed in seconds—freeing up finance professionals to focus on strategic initiatives such as risk analysis and forecasting.

Beyond automation, AI enhances financial decision-making by uncovering hidden trends and anomalies in real time. This empowers CFOs to make proactive, data-driven decisions on cost control, investment, and resource allocation.

Innovation is also accelerating. AI-powered tools now support real-time scenario planning and “what-if” simulations, enabling finance teams to model outcomes dynamically and provide faster responses to market shifts.

3. Key Statistics or Trends in AI Adoption

Finance departments are increasingly betting on AI to stay competitive. According to a 2023 Gartner report, 80% of CFOs plan to increase AI investment in their finance functions by 2026, especially in areas like FP&A and compliance automation.

The business case is compelling Deloitte found that AI-powered financial automation can reduce closing time by up to 40%, and improve forecast accuracy by 20%.

With the global AI in finance market expected to reach $64.03 billion by 2030 at a CAGR of 23.6% (Precedence Research), now is the time for organizations to act—or risk falling behind more data-savvy competitors.

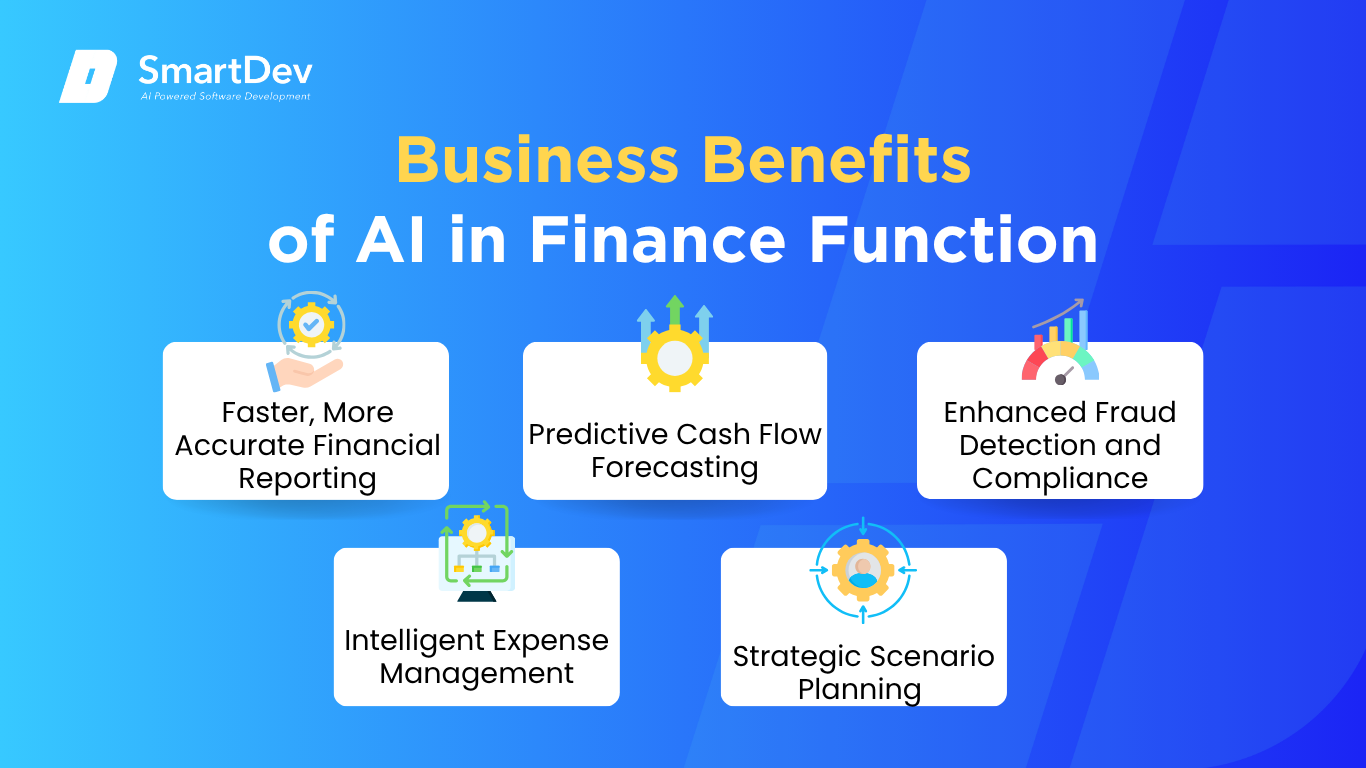

Business Benefits of AI in the Finance Function

AI in finance is more than a buzzword—it delivers measurable business value by addressing long-standing bottlenecks in speed, accuracy, and visibility. Here’s how it’s transforming five core areas:

1. Faster, More Accurate Financial Reporting

1. Faster, More Accurate Financial Reporting

AI enables continuous accounting by automatically ingesting and reconciling transactions in real time. This reduces the need for traditional month-end crunches and accelerates time-to-close.

Machine learning models also detect errors and anomalies in reporting, allowing finance teams to fix discrepancies proactively. This builds trust in financial data and improves audit readiness.

2. Predictive Cash Flow Forecasting

AI-powered models analyze historical cash flows, seasonality, and payment behaviors to forecast future liquidity needs with high accuracy. These forecasts adjust dynamically with real-time data.

This insight enables CFOs to make smarter capital allocation decisions, avoid cash shortages, and reduce reliance on manual spreadsheet-based forecasting.

3. Enhanced Fraud Detection and Compliance

AI systems can monitor thousands of transactions per second, flagging suspicious patterns based on historical fraud markers. This provides faster, more scalable fraud detection than manual reviews.

In regulatory reporting, NLP tools automatically extract, interpret, and categorize financial data—ensuring compliance with ever-evolving global standards like IFRS and SOX.

4. Intelligent Expense Management

AI automatically classifies and reconciles employee expenses by scanning receipts and matching them to policy rules. This streamlines workflows and reduces errors or abuse.

It also provides real-time analytics into spending trends, helping finance leaders identify cost-saving opportunities or enforce budget discipline.

5. Strategic Scenario Planning

AI enables finance leaders to run real-time “what-if” simulations based on changing business conditions—be it inflation, supplier disruption, or M&A opportunities.

These capabilities support agile planning and empower leadership to course-correct faster when market conditions shift.

Challenges Facing AI Adoption in the Finance Function

Despite the promise of AI, many finance teams encounter roadblocks during implementation. Understanding these challenges can help you plan more effectively and maximize ROI.

1. Siloed and Inconsistent Data

1. Siloed and Inconsistent Data

Finance teams often operate across multiple systems—ERP, CRM, and spreadsheets—leading to fragmented data silos. Inconsistent formats and missing values make it difficult for AI to learn effectively.

Consolidating data into a single source of truth and applying robust governance frameworks is essential for high-quality AI outputs.

Siloed systems and scattered data can cripple decision-making and slow growth. Discover how AI is helping organizations unify, clean, and unlock value from their data faster and smarter. Explore the full article to see how AI transforms data chaos into clarity.

2. Lack of Finance-Specific AI Talent

AI adoption requires expertise in data science, finance processes, and change management. Unfortunately, finance teams typically lack professionals who can bridge all three.

Firms often need to partner with external AI consultants or invest in upskilling internal teams to successfully deploy AI tools tailored for finance.

3. Resistance to Automation

There’s often cultural resistance among finance professionals who fear automation may replace their roles. This mindset can stall adoption.

Clear communication around AI’s role as an enabler—not a replacement—is key. Emphasizing how it enhances human judgment and strategic focus can shift perceptions.

4. Vendor Overload and Solution Fit

The market is saturated with AI tools, making it difficult to assess which solution fits your finance needs. Many tools also lack integration with legacy systems.

Start with a pilot, focusing on one pain point like invoice automation or forecasting. Then scale based on measurable outcomes and business fit.

5. Compliance and Auditability Concerns

AI systems—especially black-box models—can be hard to audit or explain. Regulators may question the transparency of AI-driven decisions.

To mitigate risk, opt for explainable AI (XAI) solutions and document decision logic. This is especially crucial in regulated sectors like banking or insurance.

For those navigating these complex waters, a business-oriented guide to responsible AI and ethics offers practical insights on deploying AI responsibly and transparently, especially when public trust is at stake.

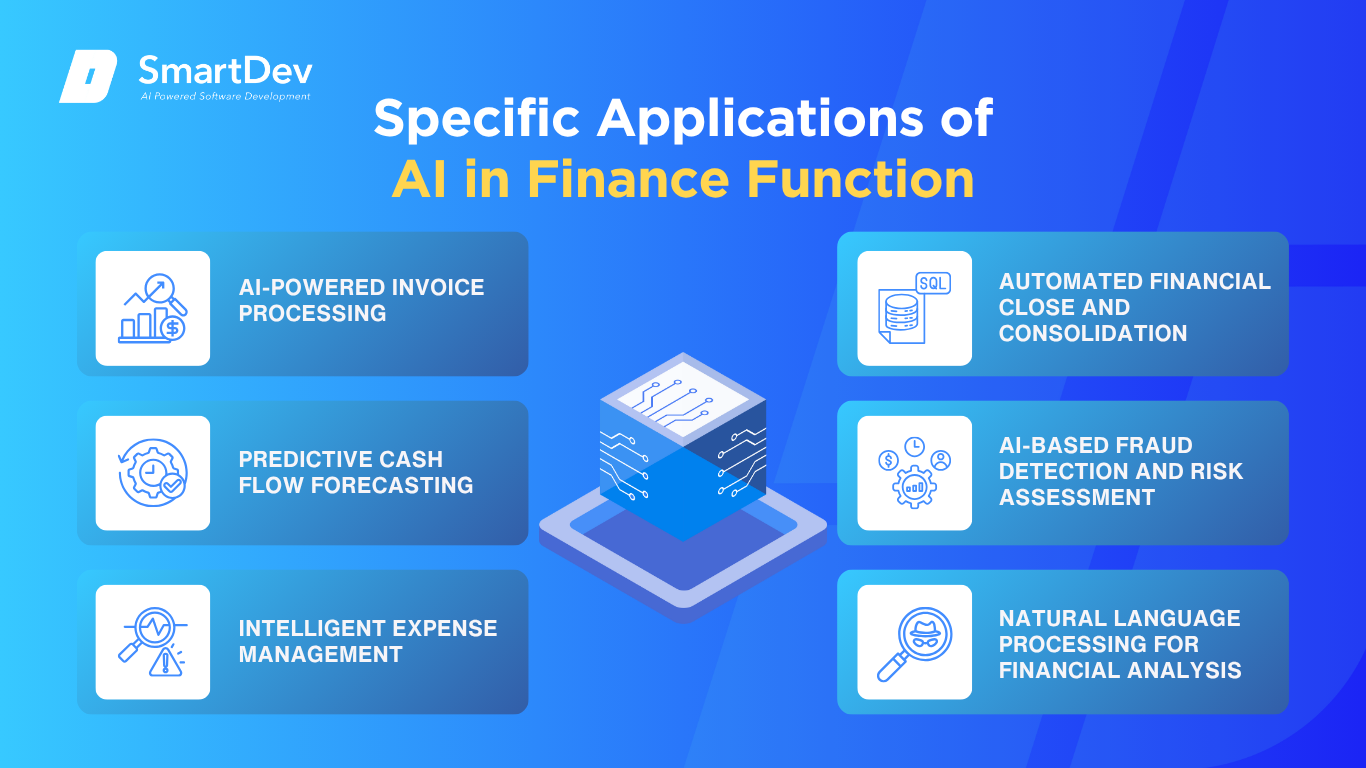

Specific Applications of AI in the Finance Function

AI is no longer a futuristic promise in the finance department—it’s a present-day imperative. Leading finance teams are deploying AI to accelerate close cycles, forecast more accurately, detect fraud in real time, and automate low-value tasks. Below are six high-impact, specific applications of AI in the finance function, each explored in depth.

Use case 1: AI-Powered Invoice Processing

Use case 1: AI-Powered Invoice Processing

Manual invoice processing has long been a burden for finance teams—slow, error-prone, and costly. AI addresses this problem through intelligent automation that extracts and validates data from invoices in various formats without human intervention. By reducing manual data entry, AI drastically cuts processing time and minimizes mistakes that could lead to compliance issues or payment delays.

At its core, AI-driven invoice processing uses optical character recognition (OCR), machine learning models, and natural language processing (NLP) to scan, interpret, and match invoice data to purchase orders and delivery receipts. These systems learn from historical data to improve accuracy over time, handling even unstructured invoices or ones with slight format variations. Integration into ERP systems like SAP or Oracle enables real-time validation and streamlined approval workflows.

The strategic value is multifaceted: faster cycle times, fewer late payments, improved vendor relationships, and real-time financial visibility. Companies can also unlock early payment discounts and eliminate invoice fraud by applying AI rules that detect anomalies or duplicate submissions. However, ensuring proper training data and addressing OCR limitations in low-resolution invoices remain key technical concerns.

Real-world case studies

In one notable example, PepsiCo used an AI-powered accounts payable solution by AppZen to automate more than 90% of its global invoice processing workload. The system cross-checked invoices with contracts and flagged exceptions for human review, reducing processing time from days to hours and improving compliance accuracy by 75%.

Use case 2: Predictive Cash Flow Forecasting

Cash flow forecasting is critical to liquidity management, yet traditional models relying on static spreadsheets often fail to reflect current realities. AI transforms forecasting by dynamically learning from past inflows and outflows, predicting future patterns based on real-time business data and external signals such as seasonality or macroeconomic trends.

These models typically leverage supervised machine learning algorithms trained on historical payment behavior, revenue cycles, vendor terms, and operational metrics. Some systems also pull real-time banking data and accounts receivable/payable schedules to continuously update projections. Cloud-based solutions often integrate directly into treasury management platforms to deliver visualized, scenario-based forecasts.

The outcome is more agile and accurate financial planning. AI forecasts help CFOs optimize cash reserves, reduce reliance on credit lines, and make proactive capital decisions. They also allow treasury teams to simulate best- and worst-case scenarios, enabling businesses to withstand market volatility. Data privacy and explainability of AI models, however, must be carefully managed to meet audit standards.

Real-world case studies

For example, Taulia, a supply chain finance provider, implemented an AI-powered forecasting engine for Airbus. This solution incorporated transaction histories, payment behaviors, and operational triggers to predict cash positions 13 weeks out, improving forecast accuracy by over 30% and optimizing working capital.

Use case 3: Intelligent Expense Management

Expense reports are tedious for employees and equally frustrating for finance teams trying to enforce policy compliance. AI automates this process by capturing receipts, classifying spending categories, and flagging anomalies in real time—all while learning company-specific policies.

These platforms rely on NLP to extract data from receipt images or emails, and classification models trained on historical transactions to assign expense categories. Rule-based engines layered with AI continuously update internal policies, ensuring the system adapts as the organization evolves. Integration with corporate card feeds and HR systems also ensures proper reconciliation and accountability.

The impact is substantial: reduced time spent by employees on filing reports, increased compliance, and fewer reimbursement errors. AI-driven dashboards also provide finance leaders with insight into trends like travel spend, entertainment costs, and policy violations—helping them manage budgets proactively. Privacy and the handling of sensitive employee data must be considered, especially under regulations like GDPR.

Real-world case studies

Global IT firm Cognizant deployed SAP Concur’s AI-driven expense management platform across its regional offices. This reduced report submission time by 60%, improved policy compliance rates by 40%, and gave finance managers real-time visibility into discretionary spending—leading to better cost control during economic uncertainty.

Use case 4: Automated Financial Close and Consolidation

The month-end close remains one of the most labor-intensive processes in finance, involving reconciliation, journal entries, data validation, and compliance reporting. AI is modernizing this function by automating repetitive close tasks and improving accuracy through anomaly detection. This reduces the time required for closing books while increasing confidence in financial statements.

Automated close solutions use machine learning to reconcile ledgers, flag unusual entries, and recommend corrective actions. NLP tools can even extract and standardize data from emails and documents used during the consolidation process. When integrated with ERP systems, these AI modules offer real-time dashboards that track close progress, identify bottlenecks, and assign accountability.

The benefits go beyond efficiency. Finance teams gain earlier access to insights, which improves responsiveness to business events and market shifts. Reduced close time also means more room for strategic analysis rather than mechanical data prep. However, ensuring auditability and maintaining controls over AI-generated entries is a common concern among regulators.

Real-world case studies

BlackLine, a leader in financial close automation, helped SiriusXM reduce its month-end close from 10 days to just 3. By applying AI to reconcile accounts and validate journal entries, SiriusXM also improved accuracy and gained near real-time visibility into its financials—freeing up analysts to focus on forecasting and strategic finance.

Use case 5: AI-Based Fraud Detection and Risk Assessment

Fraud continues to be a persistent and evolving threat in the finance world, especially with increasing transaction volumes and complex digital ecosystems. AI offers a powerful solution by continuously monitoring financial activity and detecting patterns that signal fraud, errors, or compliance breaches—often before they escalate.

These systems use unsupervised and supervised machine learning algorithms to flag anomalies in transactions, vendor profiles, or employee reimbursements. The AI adapts over time to learn new fraud tactics, drawing from both internal and external datasets. Some systems also incorporate third-party risk intelligence, customer history, and network behavior to build a complete risk profile.

The value proposition is clear: early fraud detection, reduced losses, and stronger internal controls. AI enables real-time alerts and automated workflows for investigation, helping finance and compliance teams act quickly. However, the complexity of model training and the potential for false positives must be managed to ensure effectiveness.

Real-world case studies

Mastercard’s Decision Intelligence platform uses AI to assess the fraud risk of every transaction in milliseconds. By analyzing billions of historical transactions using deep learning, the system helped issuers reduce false declines by 50% while improving fraud detection accuracy by 40%—saving millions annually and improving customer trust.

Use case 6: Natural Language Processing for Financial Analysis

Finance professionals spend a significant amount of time reviewing unstructured data like earnings calls, regulatory filings, and analyst reports. AI-powered Natural Language Processing (NLP) tools can automate this research by extracting insights, flagging sentiment, and summarizing long documents in seconds—boosting analytical capacity.

These solutions analyze tone, frequency of keywords, and context from financial narratives to detect market sentiment or early warning signals. NLP models are trained on thousands of documents and regulatory language, allowing finance teams to track compliance changes, detect risk signals, and respond to market news faster. When integrated with business intelligence platforms, they turn static content into decision-ready insight.

The operational benefits are significant: reduced manual research, improved decision-making, and accelerated risk identification. Finance teams can proactively identify issues like credit risk or earnings volatility. However, NLP’s effectiveness depends on context training and may struggle with highly technical financial language or ambiguous phrasing.

Real-world case studies

Bloomberg uses NLP in its Terminal product to analyze real-time news, earnings call transcripts, and SEC filings. Clients use this tool to instantly identify sentiment shifts, detect red flags, and benchmark language against market norms. This has empowered institutional investors to respond faster to volatility and improve trading strategies.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in the Finance Function

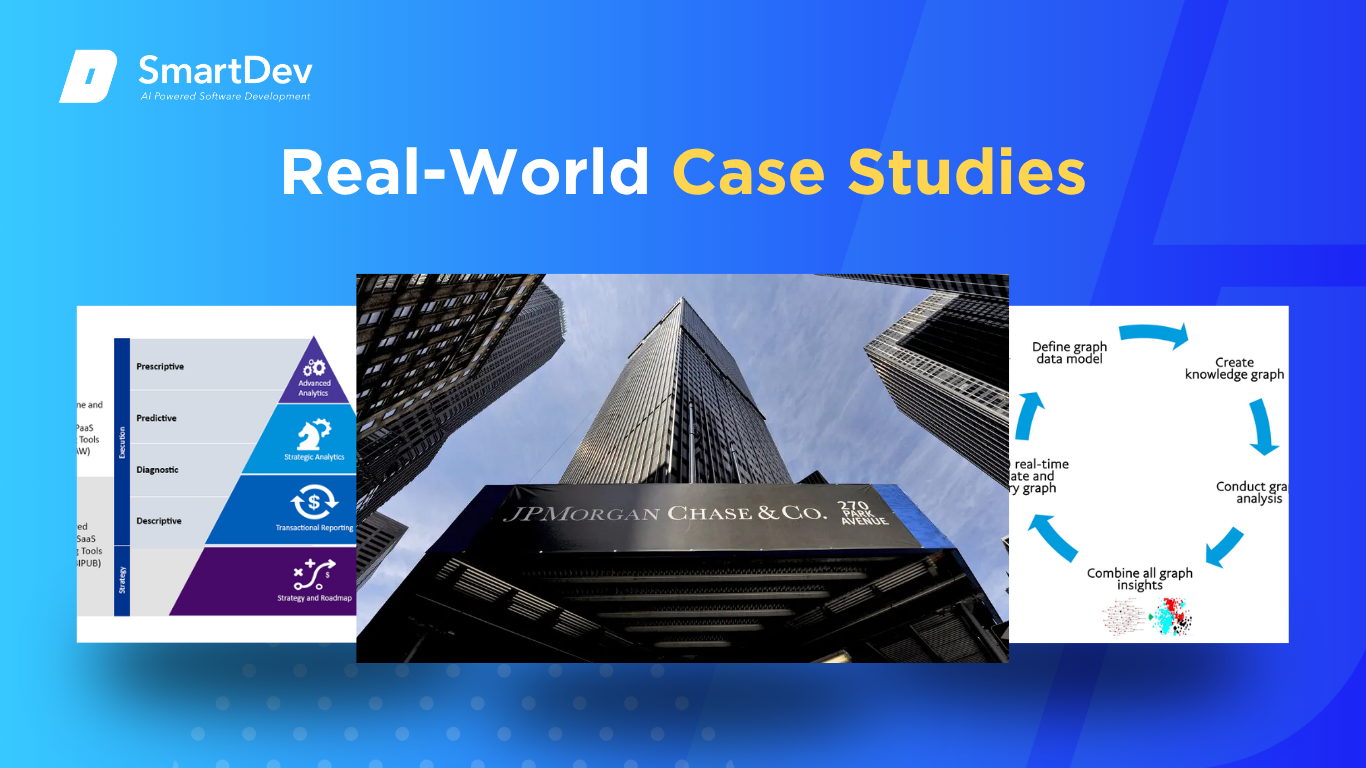

Real-world success stories help illuminate the true value of AI beyond theory. This section highlights how leading organizations have deployed AI in their finance operations—and the measurable business impact they’ve achieved. These examples provide actionable insights for finance leaders evaluating their own transformation journey.

Real-World Case Studies

JPMorgan Chase: Automating Contract Review at Scale

JPMorgan Chase launched an internal AI program called COiN (Contract Intelligence) to automate the review of commercial credit agreements. The AI leverages machine learning and NLP to extract critical clauses and terms, reducing the need for manual review. By integrating it into the back-office legal and finance workflows, the bank significantly increased processing speed without compromising accuracy.

The results were transformative: what once took 360,000 hours of legal work annually is now completed in seconds. The implementation not only improved turnaround time and compliance but also freed internal teams to focus on higher-value strategic tasks. It’s a textbook example of how AI can scale in tightly regulated finance environments.

KPMG: Elevating Audit Accuracy with AI and Data Analytics

KPMG incorporated AI into its audit and assurance services to improve anomaly detection, data sampling, and document review. The platform uses predictive models and pattern recognition to analyze large volumes of financial transactions, identifying outliers that require further audit scrutiny. AI was also integrated into natural language processing tools to extract data from contracts and regulatory filings.

This innovation led to a more data-driven, proactive audit approach. Clients benefited from increased transparency, faster reporting cycles, and enhanced risk identification. KPMG reported improved efficiency by 20–25% across certain audit workflows while maintaining strict regulatory standards.

PayPal: Combating Financial Fraud in Real Time

PayPal processes over 40,000 transactions per second globally, making fraud detection a mission-critical function. It implemented a deep learning-based AI engine that analyzes user behavior, historical patterns, and device fingerprints to flag suspicious activity before transactions are approved. The model continuously improves using reinforcement learning based on feedback from fraud investigators.

This solution reduced false positives by over 50% and prevented an estimated $4.3 billion in fraud losses in a single year. More importantly, it allowed PayPal to approve legitimate transactions faster—maintaining user trust while securing financial integrity. It’s a leading-edge example of AI’s role in balancing security with customer experience.

These examples reflect the value of working with technology partners who understand both the technical and policy implications. If you’re considering a similar digital transformation, don’t hesitate to connect with AI implementation experts to explore what’s possible in your context.

Innovative AI Solutions in the Finance Function

As the finance function evolves, so do the AI technologies shaping its future. These innovations aren’t just iterative improvements—they’re redefining how finance operates, plans, and responds.

Emerging solutions such as Generative AI are now being used to draft financial commentary, analyst reports, and audit summaries based on structured financial data. Trained on secure corporate datasets, these models speed up report generation while maintaining consistency and reducing the burden on financial analysts. Leaders like Microsoft and Workiva are actively piloting GenAI features in enterprise finance tools.

Another cutting-edge technology is Explainable AI (XAI), which enhances transparency in financial models—especially important in risk modeling and forecasting. XAI enables finance teams to justify AI-driven outcomes to regulators and auditors, increasing trust and accountability in systems like credit scoring or fraud detection.

Finally, AI-driven scenario planning tools are transforming strategic finance. These platforms combine real-time market data, operational metrics, and simulation algorithms to generate future-ready forecasts. By mapping multiple potential outcomes, finance leaders can navigate uncertainty with greater agility—turning AI into a decision-making ally rather than just an automation engine.

AI-Driven Innovations Transforming Finance Function

Emerging Technologies in AI for the Finance Function

You’re navigating a finance function increasingly transformed by AI-driven innovations. Generative AI now writes financial narratives, constructs custom dashboards, and even assists in audit summaries—boosting efficiency without compromising quality. At the same time, you’re watching computer vision tools interpret scanned documents, invoices, and even handwritten notes—turning previously inaccessible data into actionable insight.

In the finance function, generative AI models like GPT‑based agents help your team auto‑generate board reports, draft variance explanations, and produce consistent commentary across departments—a process that once took days. Computer vision systems, powered by convolutional neural networks, extract structured data from unstructured receipts and bank statements, minimizing human correction and driving accuracy in expense management. Together, these emergent technologies accelerate workflows, reduce human error, and enable real‑time decision making in finance.

AI’s Role in Sustainability Efforts

You’re also leveraging AI to drive sustainability within your finance operations. Predictive analytics uncover patterns in resource usage and waste across procurement and operations. By using historical expense data and supplier metrics, AI helps forecast waste or inefficient lines in your cost base before they compound.

AI can optimize energy consumption in finance offices by analyzing HVAC usage, lighting patterns, and occupancy through smart systems. These insights enable finance leaders to predict budget outcomes under different sustainability scenarios, aligning environmental KPIs with financial performance. Over time, you’ll not only cut costs but also refine your ESG reporting with data‑backed clarity.

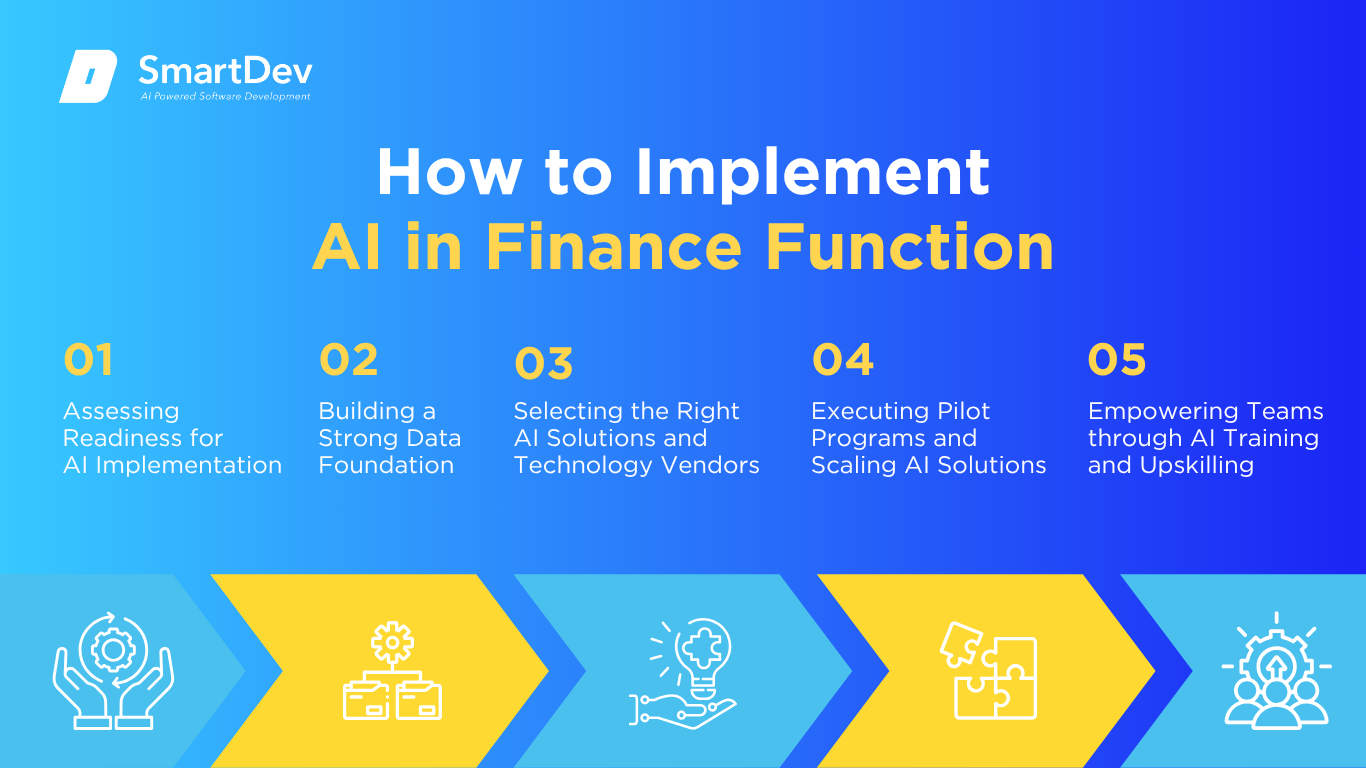

How to Implement AI in the Finance Function

Step 1: Assessing Readiness for AI Adoption

You begin by identifying areas where AI will deliver the highest value in your finance function. Start by auditing repetitive processes like reconciliations, forecasting, or report generation to assess automation readiness. Then examine compliance tasks or anomaly detection as ideal candidates for AI interventions to reduce risk.

Next, weigh your organizational appetite for change and existing infrastructure. If your data is already centralized in ERP or cloud systems, you’re ahead; if it’s fragmented across spreadsheets, you face a steeper climb. Understanding the gap between your current state and AI readiness helps you chart a roadmap that aligns with strategic business goals.

Step 2: Building a Strong Data Foundation

You must build a robust data strategy—beginning with collection, followed by cleaning and governance. Unify your financial data from ERP, CRM, and operational systems into a single data lake, ensuring accuracy, consistency, and accessibility. Rigorous data validation and standardization are essential to remove discrepancies before any AI modeling begins.

Establish governance processes that monitor data lineage, privacy, and compliance—critical in regulated finance environments. Whether tracking sourcing of expense receipts or verifying transaction flows, you need transparency and audit trails for every data input. Clean, reliable data forms the cornerstone of meaningful AI outputs and measurable ROI.

Step 3: Choosing the Right Tools and Vendors

Evaluating AI platforms tailored to finance function requires a detailed lens. Look for providers with domain‑specific capabilities: invoice OCR, anomaly detection, forecasting modules, or NLP engines suited to financial jargon. Your choice should include explainability features for audit‑readiness and seamless integration with your existing ERP or treasury systems.

Engaging vendors like experienced AI consultancies or SaaS providers can speed deployment—especially if they offer finance‑centric solutions. You’ll want solutions that support regular updates and include compliance reporting tools. By choosing tools built for finance, you not only reduce implementation risk but also maximize alignment with regulatory needs and operational workflows.

Step 4: Pilot Testing and Scaling Up

You start small—with pilot projects targeting high‑return use cases such as invoice automation or dynamic cash forecasting. Pilot deployment lets you evaluate performance, track measurable outcomes, and build internal advocacy. You don’t have to boil the ocean; even a 20‑user proof of concept can signal whether scale’s warranted.

Once outcomes prove positive—like a 30 % reduction in processing time or a 20 % improvement in forecast accuracy—you plan a phased rollout across broader teams or geographies. You fine‑tune models and workflows based on pilot feedback, iterating before scaling. This measured approach ensures you minimize risk, control costs, and build executive confidence.

Step 5: Training Teams for Successful Implementation

You upskill your finance team to work alongside AI rather than be replaced by it. Training combines AI literacy with practical workflows: how to review flagged anomalies, validate AI forecasts, or interpret AI‑generated commentary. By creating champions within finance, you reinforce adoption readiness and drive ownership of the transformation.

You also cultivate a culture where AI is seen as an augmentation tool—not a threat. Share success stories early, highlight time‑savings, and celebrate how finance professionals can pivot from repetitive tasks to strategic planning. As surveys show, only around 39 % of organizations offer structured AI training yet those that do report superior adoption outcomes.

Whether you’re exploring your first pilot or scaling an enterprise-wide solution, our team is here to help. Get in touch with SmartDev and let’s turn your supply chain challenges into opportunities.

Measuring the ROI of AI in the Finance Function

Key Metrics to Track Success

You evaluate AI ROI by analyzing how it impacts productivity, cost savings, and decision quality across finance operations. Track how many hours formerly spent on reconciliations, report drafting, or forecasting are reclaimed. Observe whether approvals are faster, error rates lower, and internal audit findings reduced.

You also measure cost reductions in headcount or outsourcing, as AI drives automation across transactional workflows. If your finance technology budget stays constant but headcount efficiency rises, that ratio itself becomes a clear ROI indicator. And if revenue‑support functions like advisory or treasury benefit from faster decision cycles, you track those incremental gains too.

Case Studies Demonstrating ROI

You look to real finance leaders who have quantified AI outcomes. Boston Consulting Group’s March 2025 survey found that while the median ROI reported by global finance executives is around 10 %, best‑practice organizations often deliver significantly higher returns by prioritizing quick‑win use cases, governance, and change manageme. Those outperformers focus on value from launch—not learning for its own sake—and sequence their deployment for cumulative results.

JPMorgan Chase serves as a stellar example: its proprietary generative AI platform supports over 200,000 employees with nearly 100 tools in production. They’ve reduced servicing costs by almost 30 %, cut operational headcount by around 10 %, and boosted customer engagement by 25 % in core banking lines. AI‑driven advisory tools like Smart Monitor have tripled productivity in wealth advisors—delivering billions in cost savings and revenue uplift.

Understanding ROI is possibly a challenge to many businesses and institutions as different in background, cost. So, if you need to dig deep about this problem, you can read AI Return on Investment (ROI): Unlocking the True Value of Artificial Intelligence for Your Business

Common Pitfalls and How to Avoid Them

You’re aware that many finance teams fall into common traps: overestimating expected returns, underinvesting in data quality, or neglecting human adoption dynamics. Firms often deploy AI into a single use case without connecting it to broader process transformation, limiting scale and impact. They also underestimate the complexity involved in auditability and compliance demands.

To avoid these missteps, you embed AI into your broader finance transformation strategy and establish cross-functional teams combining IT, finance, compliance, and change management. You insist on explainable AI and document workflows to satisfy auditors. And you maintain continuous monitoring so you can detect drift, recalibrate models, and sustain ROI rather than a one‑time lift.

Future Trends of AI in the Finance Function

Predictions for the Next Decade

Looking ahead, finance leaders will rely heavily on agentic AI—autonomous assistants capable of executing multi-step workflows, from report drafting to regulatory alerting, with minimal oversight. Reinforcement learning models will optimize cash management or portfolio decisions in real time, outperforming traditional static models.

Generative AI will become deeply embedded in CFO dashboards, producing narratives, scenario analysis, and board-ready insights in seconds. Firms like AIG are directing generative tools into underwriting, claims, and operational processes to reduce cycle times and risks. You’ll see explainable AI standards become non‑negotiable as regulators demand transparency in algorithmic predictions—driving more mature governance and auditability frameworks across finance.

How Businesses Can Stay Ahead of the Curve

To stay ahead, you should adopt a continuous innovation mindset—treating AI not as a one-off project but as a growing capability within finance. Continually harvest and enrich your data, iterate on pilot results, and scale mature AI tools into adjacent workflows. Engage in cross-industry collaborations—finance peers and AI vendors—to share best practices and co‑innovate.

You also invest in AI governance infrastructure: model registries, explainability dashboards, and monitoring controls that align with compliance standards. Embrace explainable AI tools for high-impact areas like credit decisions and fraud detection. Together, these practices transform AI from a technical experiment into a strategic capability that evolves with your business.

Conclusion

Summary of Key Takeaways on AI Use Cases in Finance Function

You’ve seen how AI is transforming the finance function across invoice automation, forecasting, fraud detection, and NLP‑driven analysis. Success hinges on building a strong data foundation, piloting high‑value use cases, selecting purpose‑built tools, and embedding AI into your broader finance transformation. Real‑world results, like JPMorgan’s multi‑billion dollar gains and BCG’s ROI insights, underscore that finance teams who follow best practices unlock meaningful impact and strategic agility.

Moving Forward: A Path to Progress for Businesses Considering AI Adoption

If you’re ready to fuel your finance transformation with AI, start with a readiness assessment—identify 1‑2 pilot use cases, secure executive sponsorship, and build cross‑functional teams. Track outcome metrics rigorously, adopt explainable tools, and scale based on insight waves—not hype.

At SmartDev, we help companies like yours integrate tailored AI solutions that drive efficiency, transparency, and future-ready innovation. Contact us today to explore how AI can elevate your finance function—and deliver measurable ROI from day one.

References

- Advancing the Finance Function with Artificial Intelligence

- How AI can be leveraged for the finance function

- What is artificial intelligence (AI) in finance?

- AI in Finance: Applications, Examples & Benefits

- What an AI-powered finance function of the future looks like

- Five ways that AI is changing finance

- KPMG Global AI in finance report

1. Definition of AI and Its Core Technologies

1. Definition of AI and Its Core Technologies 1. Faster, More Accurate Financial Reporting

1. Faster, More Accurate Financial Reporting 1. Siloed and Inconsistent Data

1. Siloed and Inconsistent Data Use case 1: AI-Powered Invoice Processing

Use case 1: AI-Powered Invoice Processing