Introduction

Internal audit plays a crucial role in ensuring organizations remain compliant, manage risk effectively, and operate efficiently. However, as businesses grow in complexity, the volume of data increases, and the regulatory environment becomes more demanding, traditional auditing methods are becoming less effective. Artificial Intelligence (AI) is offering internal auditors innovative tools to streamline operations, improve accuracy, and provide actionable insights.

What is AI and Why Does It Matter in Internal Audit?

Definition of AI and Its Core Technologies

Artificial Intelligence (AI) refers to systems that mimic human intelligence, using technologies like machine learning, natural language processing (NLP), and anomaly detection. These tools help analyze large datasets, detect patterns, and automate tasks that were previously manual and error-prone.

In internal audit, AI enhances processes such as risk assessment, compliance checks, and fraud detection. Machine learning identifies trends from historical data, while NLP analyzes unstructured data like emails. Anomaly detection flags discrepancies in real time, improving audit accuracy and efficiency.

The Growing Role of AI in Transforming Internal Audit

AI is transforming internal audit by automating routine tasks and enhancing risk detection. Unlike traditional audits that rely on sampling, AI analyzes entire datasets, providing more accurate insights and identifying potential issues in real-time. This allows auditors to address risks proactively, rather than reactively.

Moreover, AI helps auditors make better decisions by offering predictive analytics. By analyzing past data, AI can forecast risks or compliance issues before they arise, enabling auditors to take preventive actions. This shift allows internal audits to become more strategic, driving better governance and operational efficiency.

Key Statistics and Trends Highlighting AI Adoption in Internal Audit

AI adoption in internal audit is rapidly increasing, with 39% of auditors currently using AI, and 41% planning to implement it by 2026, according to a 2025 Wolters Kluwer survey. This shift is driven by the need for enhanced efficiency and better risk detection in audit processes. As AI tools become more advanced, their role in internal audits continues to expand.

AI is delivering tangible benefits, such as reducing time spent on routine tasks. Deloitte reports that AI can cut control testing time by up to 40%, freeing auditors to focus on more strategic activities. This efficiency boost improves overall audit quality and enables teams to add more value.

The global AI in audit market is set for significant growth, with projections estimating it will reach $11.7 billion by 2033, growing at a CAGR of 27.9%. This growth reflects the increasing reliance on AI to enhance audit accuracy, risk management, and compliance.

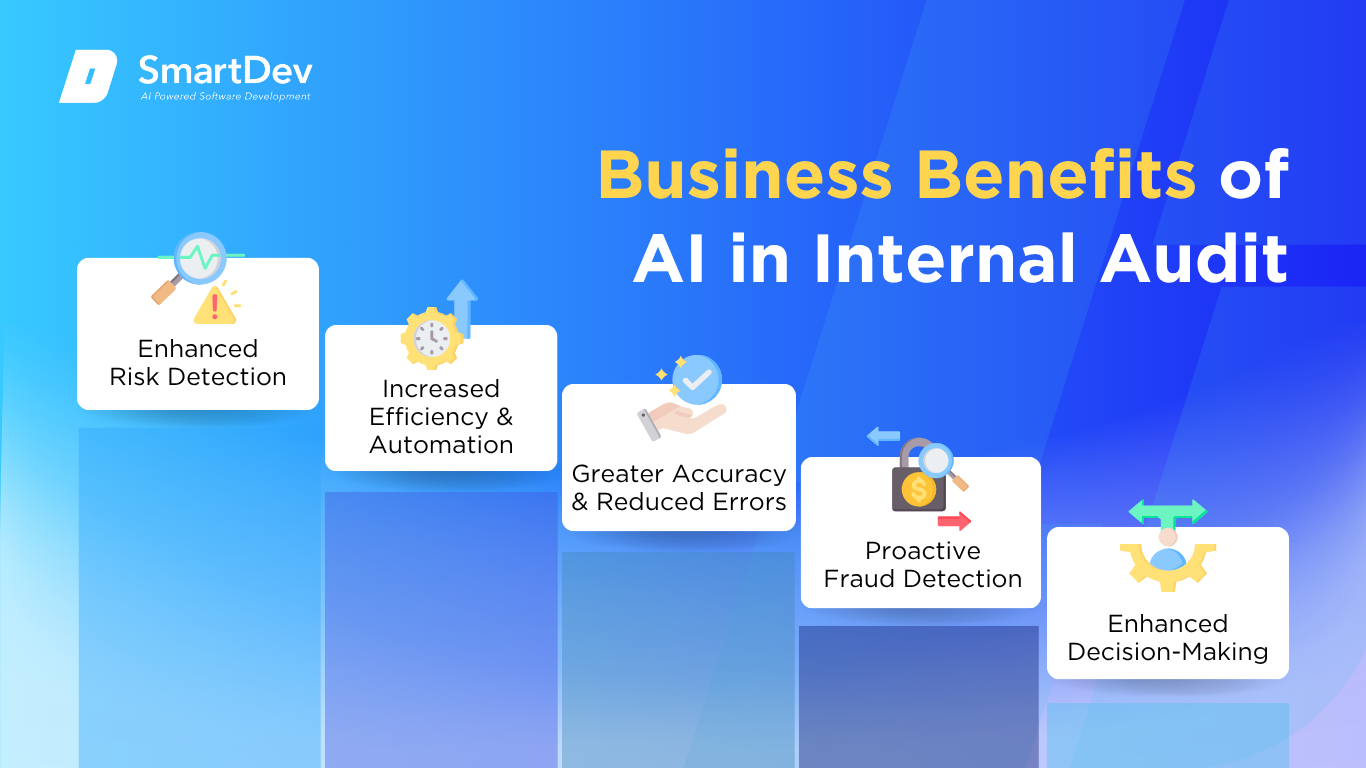

Business Benefits of AI in Internal Audit

AI offers several key advantages for internal audit functions, helping organizations improve risk detection, increase efficiency, and make more informed decisions. These benefits drive better overall performance by automating repetitive tasks and enhancing audit accuracy, allowing auditors to focus on more strategic areas.

1. Enhanced Risk Detection

AI helps internal audit by analyzing entire datasets, identifying hidden patterns and anomalies that might be overlooked with traditional sampling. This comprehensive approach enhances the accuracy of risk detection, allowing auditors to flag potential issues in real time.

The ability to continuously learn from data means the system becomes more adept at identifying emerging risks over time. As a result, auditors can proactively address high-priority concerns before they escalate into significant problems, improving overall risk management.

2. Increased Efficiency and Automation

Automating repetitive tasks like data extraction, transaction analysis, and compliance checks allows auditors to focus on more strategic and complex tasks. This automation speeds up the audit process, reducing the time spent on manual efforts and increasing productivity.

With real-time monitoring, audit functions stay active and responsive to emerging issues. This ensures auditors can quickly address potential risks and reduce delays, ultimately making the audit process more agile and efficient.

3. Greater Accuracy and Reduced Errors

Automated systems ensure that audits are more precise, eliminating the risk of human error. By processing vast amounts of data consistently, AI ensures that every transaction is analyzed, which leads to more reliable audit results.

Moreover, advanced algorithms can detect subtle discrepancies that might be missed by human auditors. This improved accuracy helps identify potential fraud, errors, or compliance issues, leading to more trustworthy audit outcomes.

4. Proactive Fraud Detection

AI’s ability to analyze data in real time enhances fraud detection by identifying irregular transactions and patterns early. By flagging suspicious activities, auditors can intervene before any significant damage occurs, preventing financial losses and reputational harm.

The system’s continuous learning ensures that it adapts to emerging fraud techniques, strengthening the organization’s defense over time. As the AI model improves, it becomes increasingly effective at detecting new types of fraudulent behavior, offering long-term protection.

5. Enhanced Decision-Making

Data-driven insights allow auditors to predict potential risks and compliance issues before they arise. By analyzing historical data, AI helps auditors make more informed decisions, leading to proactive risk mitigation strategies.

Additionally, continuous feedback from AI tools enables auditors to evaluate internal controls and suggest improvements. This ensures that internal audit practices remain effective and aligned with organizational goals, optimizing decision-making and governance.

Challenges Facing AI Adoption in Internal Audit

While AI presents numerous benefits, its adoption in internal audit comes with challenges that organizations must address. From data quality issues to resistance from employees, understanding these obstacles is essential for successfully implementing AI tools and maximizing their impact.

1. Data Quality and Integration Issues

AI relies heavily on high-quality data for accurate analysis and decision-making. However, many organizations struggle with fragmented, inconsistent, or unstructured data, making it difficult for AI systems to provide reliable insights. Without clean, centralized data, AI tools cannot effectively perform tasks like fraud detection or risk assessment, hindering the value they can provide.

Integrating AI solutions into legacy systems further complicates this challenge. Many internal audit functions still rely on outdated technology or siloed data sources, which makes seamless integration of AI tools difficult. Organizations need to invest in data cleansing and integration strategies to ensure AI can deliver optimal results.

To learn how unstructured data can be effectively leveraged in AI applications, check out our detailed guide on how AI unlocks the power of unstructured data.

2. High Implementation Costs

Implementing AI tools in internal audit can be costly, especially for organizations with limited budgets or smaller audit teams. The costs include purchasing AI software, integrating it into existing systems, and training staff to use these advanced tools effectively. These initial investments may discourage some organizations from adopting AI, particularly if the perceived ROI isn’t immediately clear.

However, the long-term benefits, such as improved efficiency and reduced labor costs, can outweigh the initial expenses. Organizations must carefully assess the financial impact of AI adoption and determine whether the value it brings justifies the upfront costs.

3. Resistance to Change

Introducing AI into internal audit often meets resistance from employees who are accustomed to traditional methods. Auditors may fear that AI could replace their roles, leading to reluctance in embracing new technologies. This resistance can slow down the adoption process and result in underutilization of AI tools.

To overcome this challenge, organizations must focus on upskilling their audit teams. By emphasizing that AI will complement human auditors, not replace them, companies can encourage staff to adopt AI solutions, ensuring a smoother transition and better utilization of the technology.

4. Lack of Skilled Personnel

AI tools require specialized skills to implement, manage, and maintain, which many internal audit teams may not have. Finding or training employees with the necessary expertise in AI, machine learning, and data analytics can be a significant hurdle. This skill gap can prevent organizations from fully realizing the potential of AI in internal audits.

Investing in training programs and partnering with external experts can help bridge this gap. By building a team with the right AI and data analytics skills, organizations can better harness the power of AI to improve audit processes and decision-making.

5. Ethical and Regulatory Concerns

The use of AI in internal audit raises concerns about ethics, bias, and regulatory compliance. AI systems can introduce bias if trained on incomplete or unrepresentative data, leading to inaccurate conclusions. Additionally, evolving regulatory guidelines make it challenging for organizations to stay compliant.

To address these risks, businesses must ensure transparency in AI models and establish strong governance frameworks. Regular audits of AI tools for bias and compliance with regulations will help mitigate these concerns and ensure ethical adoption.

Explore how ethical and explainability concerns are addressed in real-world deployments in our detailed guide on AI ethics concerns.

Specific Applications of AI in Internal Audit

1. Fraud Detection with AI

AI-powered fraud detection uses machine learning algorithms to analyze large datasets and identify suspicious activities in real-time. Traditional methods involve manual checks that are time-consuming and prone to human error, whereas AI continuously monitors transactions for irregular patterns. By processing large volumes of data, AI can quickly detect fraud, reducing the risk of financial losses.

Machine learning models are trained on historical data, allowing AI systems to identify deviations from normal behavior, such as unusual transactions or unauthorized access. As these systems learn from new data, they become better at detecting emerging fraud techniques. This continuous learning makes AI a powerful tool in combatting fraud across industries.

The key benefit of AI in fraud detection is its ability to provide real-time alerts, significantly improving response times. With AI, auditors can address suspicious activities immediately, reducing the window for fraud to escalate. This automation improves the overall accuracy and efficiency of fraud detection processes, safeguarding businesses from financial harm.

Real-world example:

JPMorgan Chase leverages IBM Watson’s AI platform to analyze transactional data, detecting irregularities and alerting auditors in real-time. This system has reduced fraud detection time by 60%, enhancing operational efficiency and improving the accuracy of audits.

2. Predictive Risk Assessment

AI-driven predictive analytics improves internal audits by forecasting potential risks before they occur. Traditional risk assessments are reactive, relying on past data and manual analysis, while AI can predict future risks by analyzing real-time data. By assessing various factors such as market trends and operational data, AI provides a clearer picture of future risks.

These AI models learn from historical data and identify patterns that suggest emerging risks, such as financial instability or compliance violations. With continuous data processing, AI can predict high-risk scenarios, allowing auditors to prioritize and mitigate those risks before they materialize. This proactive approach allows internal audit teams to be more strategic in their efforts.

AI’s predictive capabilities allow internal auditors to shift from reactive to proactive risk management. By identifying potential issues early, AI enables auditors to allocate resources efficiently and focus on the most critical risks. This increases the effectiveness of audits and enhances overall risk mitigation strategies.

Real-world example:

Deloitte uses AI tools to assess and mitigate operational and financial risks for clients, helping predict potential compliance issues and market risks. One major client saw a 30% reduction in risk exposure and substantial savings by addressing problems before they escalated into more costly issues.

3. Continuous Monitoring and Reporting

AI enables continuous monitoring of business processes and compliance, offering real-time insights into organizational activities. Traditional audits are performed periodically, which can delay the identification of issues. AI, however, provides continuous oversight, ensuring that potential risks or non-compliance are detected and addressed immediately.

By integrating with business systems like ERPs and CRMs, AI analyzes data in real-time, flagging discrepancies, unauthorized activities, or compliance violations. These continuous checks ensure that problems are identified early and corrective actions can be taken without waiting for periodic audits. Real-time reporting also enhances auditors’ ability to make quick, informed decisions.

The primary advantage of continuous auditing is its ability to reduce the time and resources spent on manual audits while maintaining high accuracy. By automating reporting and alerting, AI frees up auditors to focus on higher-priority tasks, ensuring that audits are both efficient and thorough.

Real-world example:

Siemens integrated AI-powered continuous monitoring tools to track real-time operational data, detecting discrepancies or compliance breaches instantly. This system improved audit efficiency by reducing cycle times by 40%, while also strengthening risk detection.

4. Automated Audit Trail Analysis

AI automates the review of audit trails, identifying discrepancies and unauthorized changes in transaction logs. Traditionally, audit trails are reviewed manually, which can be time-consuming and error-prone. AI, however, uses machine learning algorithms to analyze large amounts of transaction data quickly and accurately, flagging any irregularities for further investigation.

By continuously monitoring audit trails, AI identifies unauthorized activities, such as fraudulent transactions or breaches in security. The system compares real-time data to historical trends, automatically detecting any deviations. Over time, AI models learn from these activities and improve their ability to detect emerging threats.

AI’s ability to provide real-time, automated audit trail analysis enhances the efficiency and effectiveness of internal audits. Auditors can quickly investigate flagged transactions, significantly reducing the time spent on manual reviews. This leads to faster, more accurate audits and better internal controls.

Real-world example:

EY (Ernst & Young) implemented an AI-powered audit trail analysis tool to automatically detect discrepancies in financial records. This tool helped flag unauthorized access and fraudulent activities in real-time, reducing audit cycle time by 25% and improving overall audit accuracy.

5. AI-Powered Chatbots for Auditors

AI chatbots assist auditors by automating routine tasks such as answering queries, retrieving documents, and interpreting regulatory requirements. These chatbots use natural language processing (NLP) to communicate with auditors, allowing them to interact with audit systems in real-time. This reduces the time auditors spend on administrative tasks, enabling them to focus on more strategic audit activities.

AI chatbots can access vast amounts of data and provide quick answers to auditors’ queries, such as retrieving audit reports or explaining complex compliance rules. The system also learns from user interactions, improving its responses and becoming more efficient over time. By automating routine processes, chatbots ensure that auditors can obtain critical information faster and more efficiently.

The operational benefit of AI-powered chatbots is clear: they significantly reduce manual labor, increase audit productivity, and improve the accuracy of information retrieval. With chatbots handling routine inquiries, auditors can devote more time to analyzing risks and providing valuable insights to the organization.

Real-world example:

KPMG implemented AI-powered chatbots to assist auditors by answering queries and retrieving necessary documents. This automation reduced the time spent on administrative tasks by 30%, allowing auditors to focus on more complex analysis. As a result, KPMG improved audit efficiency and enhanced overall audit quality.

6. AI-Driven Regulatory Compliance

AI assists internal auditors in managing regulatory compliance by automatically tracking regulatory changes and ensuring organizations remain up to date with new laws. As regulations continuously evolve, AI systems automatically scan legal documents and highlight any relevant updates that could impact the organization’s compliance obligations. This allows auditors to focus on implementing necessary adjustments rather than manually reviewing vast amounts of regulatory data.

AI systems use natural language processing (NLP) to understand complex regulatory language, automatically extracting compliance rules and integrating them into audit workflows. These systems provide real-time alerts when regulatory changes occur, helping auditors stay proactive in managing compliance. By automating these processes, AI significantly reduces the manual effort involved in staying compliant with ever-changing regulations.

The strategic advantage of AI in regulatory compliance is its ability to streamline and automate compliance checks while ensuring that audits remain timely and comprehensive. This not only minimizes the risk of non-compliance but also improves audit accuracy and reduces penalties. AI’s real-time monitoring ensures auditors can respond immediately to regulatory changes, preventing costly compliance violations.

Real-world example:

PwC uses AI-driven tools to track and interpret regulatory changes, ensuring that internal audits remain compliant with current laws. The system automatically updates audit workflows with the latest compliance requirements, reducing the time spent on manual reviews by 40%. This has improved overall audit efficiency and helped clients maintain consistent compliance.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in Internal Audit

With AI driving significant advancements in internal audit processes, organizations are increasingly adopting these technologies to enhance accuracy and efficiency. These examples highlight the transformative role AI is playing in real-world audit practices.

Real-World Case Studies

1. JPMorgan Chase: COiN for Contract Review and Fraud Detection

JPMorgan Chase has implemented IBM Watson’s COiN (Contract Intelligence) to automate contract review, allowing the bank to process documents far more efficiently than manual methods. The AI platform uses machine learning to analyze large volumes of contracts, extracting key data points and flagging potential issues or errors. This automation has saved the bank significant time and resources, allowing human employees to focus on higher-value tasks.

In addition to contract review, JPMorgan uses AI to detect fraud by continuously analyzing transactional data for anomalies. The AI system helps auditors identify fraudulent activities quickly by comparing transactions to historical data, continuously learning from patterns to improve its accuracy. This proactive approach to fraud detection reduces the time spent on manual reviews and ensures faster identification of suspicious activities.

2. Deloitte: AI in Risk Assessment and Compliance

Deloitte integrates AI into its risk assessment processes to offer more accurate and real-time predictions of financial and regulatory risks. The AI system continuously analyzes a wide range of data sources, including historical data and market conditions, helping auditors identify emerging risks before they escalate. This proactive method allows Deloitte to offer more strategic insights to its clients, improving decision-making and minimizing unforeseen financial disruptions.

By automating risk analysis and compliance checks, Deloitte also helps its clients ensure they stay up to date with changing regulations. The AI system alerts auditors about potential compliance issues, enabling them to take immediate action. This reduces the likelihood of non-compliance and penalties, enhancing both the efficiency and accuracy of internal audits.

3. Siemens: Continuous Monitoring and Operational Efficiency

Siemens employs AI-powered continuous monitoring systems to track operational data and ensure compliance across its global operations. By integrating AI with its business systems, Siemens can detect discrepancies and compliance breaches in real-time. This proactive monitoring enables auditors to immediately address issues as they arise, ensuring the company remains efficient and compliant without waiting for periodic audits.

The implementation of continuous monitoring has led to a significant reduction in audit cycle times, with Siemens reporting a 40% decrease in the time required to complete audits. The AI system’s real-time capabilities allow auditors to focus on more complex, high-priority tasks, rather than spending time on routine data checks. This improves both the speed and effectiveness of Siemens’ internal audit processes.

Innovative AI Solutions

Innovative AI solutions are transforming internal auditing by enabling faster and more accurate analysis. Natural Language Processing (NLP) helps auditors process large volumes of unstructured data like contracts and financial reports, while deep learning detects complex patterns in datasets, improving fraud detection.

Additionally, AI integrated with IoT enables continuous real-time monitoring, allowing auditors to detect inefficiencies and compliance issues instantly. These solutions make audits more proactive and efficient, enhancing decision-making and improving overall audit effectiveness.

Explore how AI streamlines workflows and drives performance improvements in our guide to unlocking operational efficiency with AI.

AI-Driven Innovations Transforming Internal Audit

Emerging Technologies in AI for Internal Audit

AI is transforming internal audits by automating routine tasks and streamlining data analysis. With machine learning and natural language processing, auditors can quickly identify risks and anomalies in large datasets, improving both efficiency and accuracy. This allows audit teams to shift focus to more strategic decision-making.

AI’s predictive capabilities also help auditors anticipate potential risks based on historical data trends. This proactive approach enables businesses to address issues before they escalate, improving overall risk management. As AI continues to evolve, its role in enhancing internal audits will only grow.

AI’s Role in Sustainability Efforts

AI plays a crucial role in sustainability by helping businesses optimize resource use and reduce waste. Through predictive analytics, AI can forecast demand, streamline supply chains, and minimize overproduction, leading to a more efficient allocation of resources. This helps companies meet sustainability goals while also improving operational efficiency.

Additionally, AI-powered systems can monitor and optimize energy consumption in real time, identifying inefficiencies and suggesting improvements. By integrating AI into sustainability audits, organizations can ensure compliance with environmental regulations and reduce their carbon footprint, ultimately contributing to a more sustainable future.

How to Implement AI in Internal Audit

Implementing AI in internal audit can significantly enhance efficiency, accuracy, and risk management. By carefully assessing readiness, building a solid data foundation, and ensuring proper training, businesses can seamlessly integrate AI to transform their audit processes.

Step 1: Assessing Readiness for AI Adoption

Before integrating AI into your internal audit processes, evaluate your organization’s digital maturity. Identify tasks that are repetitive and time-consuming, such as data extraction or compliance checks, which are ideal candidates for automation. It’s also crucial to assess leadership support and the openness of internal teams to adopting AI, as success largely depends on organizational buy-in.

The readiness assessment should include considering whether the company’s existing systems and processes are compatible with AI solutions. Having a clear understanding of your team’s willingness to embrace change will ensure that AI adoption can proceed smoothly and effectively.

Explore our data analytics services to see how we help businesses implement AI solutions that scale.

Step 2: Building a Strong Data Foundation

AI relies heavily on accurate, clean, and structured data. Begin by organizing and standardizing your audit data to ensure that it is ready for AI processing. This includes setting up consistent data collection processes and ensuring data integrity across the board.

Implementing data governance practices will help maintain the accuracy, security, and compliance of the data. A centralized system that allows your team to access up-to-date, reliable data will support the AI models in delivering valuable insights while ensuring scalability.

Explore why clean, well-governed data is the foundation of successful AI adoption in our data management guide.

Step 3: Choosing the Right Tools and Vendors

Selecting the right AI tools is essential for a smooth integration. Look for AI solutions tailored to the needs of internal audits, offering scalability, compatibility, and the necessary functionalities to enhance audit processes. It’s important to ensure that the chosen tools can seamlessly integrate with your existing systems for a smooth transition.

Vendor transparency is key – understand how your data will be handled, especially in terms of security and privacy. Choose vendors who offer ongoing support and regular updates to adapt to future needs and advancements in AI technology.

Step 4: Pilot Testing and Scaling Up

Starting with a pilot phase allows you to test AI tools on a small scale before full implementation. Pick a low-risk area where AI can demonstrate immediate value, such as automating routine compliance checks. This helps refine processes and addresses any challenges in a controlled environment.

Once you see success in the pilot phase, use the results to expand the AI application across broader audit functions. Gather feedback from stakeholders, analyze performance, and fine-tune the system to ensure a smooth transition to larger-scale deployment.

Step 5: Training Teams for Successful Implementation

Ensure that internal audit teams are properly trained to use AI tools effectively. This includes providing training on specific AI applications and how they complement the audit process. Equipping auditors with the right skills will increase adoption and help them integrate AI-driven insights into their decision-making.

Foster collaboration between audit and IT teams to ensure smooth integration. A well-prepared workforce will be more confident in using AI, leading to better results and increased productivity across the audit function.

To ensure successful AI integration, institutions should start with a clear roadmap. Our guide for tech leads outlines how to assess readiness and align stakeholders from the start.

Measuring the ROI of AI in Internal Audit

Key Metrics to Track Success

Productivity gains and cost savings are key metrics for evaluating AI’s ROI. Automation of tasks like data analysis and fraud detection reduces audit cycle times, allowing auditors to focus on higher-value work. The time saved is a clear indicator of AI’s impact on operational efficiency.

Cost savings also play a crucial role in measuring ROI. AI reduces the need for additional staff and minimizes errors, lowering operational costs. By identifying inefficiencies and preventing fraud, AI helps organizations avoid financial losses, further showcasing its ROI in internal audits.

Case Studies Demonstrating ROI

WestRock, a global packaging company, integrated generative AI into its internal audit processes, automating tasks like drafting audit objectives and creating risk matrices. This significantly reduced manual work, enhancing efficiency and allowing auditors to focus on higher-value tasks, demonstrating a clear ROI in audit outcomes and resource optimization.

Similarly, EY’s AI tools, including the EYQ platform, have streamlined accounting tasks, cutting down on administrative work and enabling auditors to focus on risk assessment. This $1 billion investment in AI tools has resulted in major time savings and improved audit quality, underscoring the firm’s ROI in adopting AI technology.

Common Pitfalls and How to Avoid Them

A common pitfall is not setting clear, measurable goals before AI implementation. Without specific benchmarks, it’s difficult to assess AI’s effectiveness. Businesses should define clear objectives like reducing audit time or preventing fraud to track AI’s success.

Another challenge is overestimating AI’s capabilities. While AI automates tasks, human oversight is still necessary for complex decisions. Balancing automation with human expertise ensures AI complements the audit process, maximizing ROI without overlooking critical analysis.

Future Trends of AI in Internal Audit

Predictions for the Next Decade

In the next decade, AI in internal audit will continue to evolve, with more advanced predictive analytics and real-time risk detection becoming integral to audit processes. AI-powered tools will increasingly leverage machine learning and data mining to uncover hidden risks, automate compliance monitoring, and provide deeper insights into financial and operational health. As AI models become more explainable, auditors will have greater confidence in using these insights to make data-driven decisions.

To stay ahead, businesses must invest in AI innovation and continuously upskill audit teams. Internal auditors will need to collaborate with AI tools to interpret complex data and address emerging risks efficiently.

How Businesses Can Stay Ahead of the Curve

To stay ahead, businesses must continually invest in AI technologies and innovation, ensuring tools evolve with audit needs. Fostering a culture of collaboration between audit and IT teams will streamline AI integration into processes.

Additionally, businesses should prioritize upskilling audit teams to effectively leverage AI insights. Providing ongoing training will help auditors leverage AI-driven insights and maintain their strategic role in the decision-making process. This combination of technology investment and skill development will keep businesses competitive and agile in an increasingly data-driven landscape.

Conclusion

Key Takeaways

AI is revolutionizing internal audit by automating tasks, enhancing risk detection, and providing valuable insights for decision-making. Key use cases include predictive analytics, real-time fraud detection, and audit process optimization, all contributing to improved audit quality and cost reduction.

To successfully implement AI, businesses should assess readiness, build a strong data foundation, and invest in team training. By measuring ROI through productivity and cost savings, businesses can demonstrate AI’s value, ensuring it drives efficiency and better risk management in the future.

Moving Forward: A Strategic Approach to AI-Driven Transformation

As AI continues to transform internal audit, now is the time to leverage its full potential to enhance audit efficiency, improve risk management, and reduce costs. From automating routine tasks to providing deeper insights for strategic decision-making, AI is crucial for staying ahead in an increasingly data-driven landscape.

At SmartDev, we specialize in implementing AI solutions that streamline audit processes and improve overall productivity. Whether you’re looking to automate compliance checks, enhance fraud detection, or optimize audit cycles, our team helps you integrate AI technologies that deliver measurable value and long-term impact.

Explore our AI-powered software development services to see how we can help you drive smarter, more efficient audits across your organization.

Contact us today to learn how AI can elevate your internal audit function and provide a competitive edge in managing risk and compliance.

—

References:

- AI in Audit Market Size, Share | Market.us

- Generative AI in Audit Market | Dimension Market Research

- Case Studies: Successful AI Implementations in Various Industries | Capella Solutions

- Is it time to audit the value of artificial intelligence? Artificial intelligence insights for internal audit | Deloitte

- Continuous monitoring of business process controls: A pilot implementation of a continuous auditing system at Siemens | Internal Journal of Accounting Information Systems

- Inside the process: how EY navigated its own AI-driven transformation | EY

- Generative AI for internal audit: Scope, integration strategies, use cases, challenges and future outlook | zbrain.ai

- Responsible AI and internal audit: what you need to know | PwC

- How WestRock Harnessed GenAI to Enhance Internal Audit | The Wall Street Journal