The financial services industry is rapidly evolving, driven by the growing demand for AI solutions. As fintech becomes more complex, the need for technologies that streamline operations, enhance customer experiences, and ensure compliance has never been greater. AI-powered search assistants are at the forefront, helping institutions automate tasks, improve data access, and make better decisions. From extracting data from receipts to providing real-time insights, AI is transforming financial operations.

AI knowledge assistants, especially AI search tools for finance, are crucial in today’s fintech landscape. These systems enable businesses to quickly retrieve and manage vast data with greater accuracy and speed. Automated data retrieval improves efficiency, reduces errors, and cuts costs. By enhancing compliance and decision-making, AI streamlines workflows and helps financial institutions stay competitive. With intelligent data extraction and real-time access, AI is becoming an essential tool for optimizing operations and delivering superior customer service in fintech.

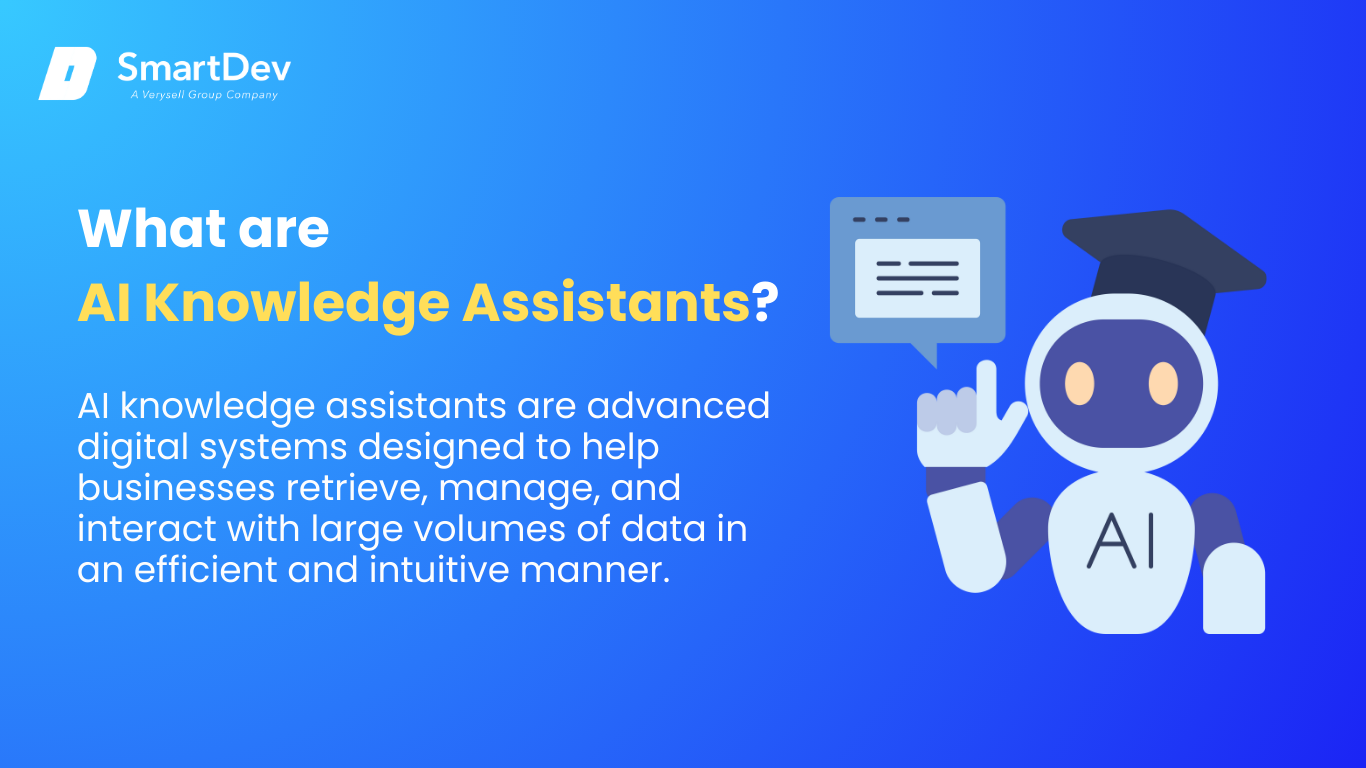

What Are AI Knowledge Assistants?

AI knowledge assistants are advanced digital systems designed to help businesses retrieve, manage, and interact with large volumes of data in an efficient and intuitive manner. These AI-driven tools utilize natural language processing (NLP), machine learning, and intelligent data extraction techniques to deliver accurate and contextually relevant responses to user queries.

For financial institutions, AI knowledge assistants serve as a pivotal resource for improving decision-making, enhancing compliance, and automating complex processes. They enable users to seamlessly access structured and unstructured data, including financial records, receipts, and regulatory guidelines, by simply asking questions in natural language. With the power of AI, these systems offer real-time data access, making it easier for businesses to act on insights faster and with greater accuracy.

Core Features of AI Knowledge Assistants

- Automated Data Retrieval: AI systems can instantly fetch relevant information from vast data sources, significantly speeding up the process of data access.

- Intelligent Data Extraction: AI can extract critical data from complex documents, such as receipts, invoices, and financial records, reducing the need for manual input.

- Real-Time Data Access: AI knowledge assistants provide up-to-date insights, allowing businesses to act on the most current financial data instantly.

- Integration with Financial Systems: Seamlessly integrates with existing financial systems, optimizing workflows and reducing operational costs.

These capabilities make AI-powered search assistants indispensable in the financial industry by streamlining everyday tasks and providing high-level operational efficiencies.

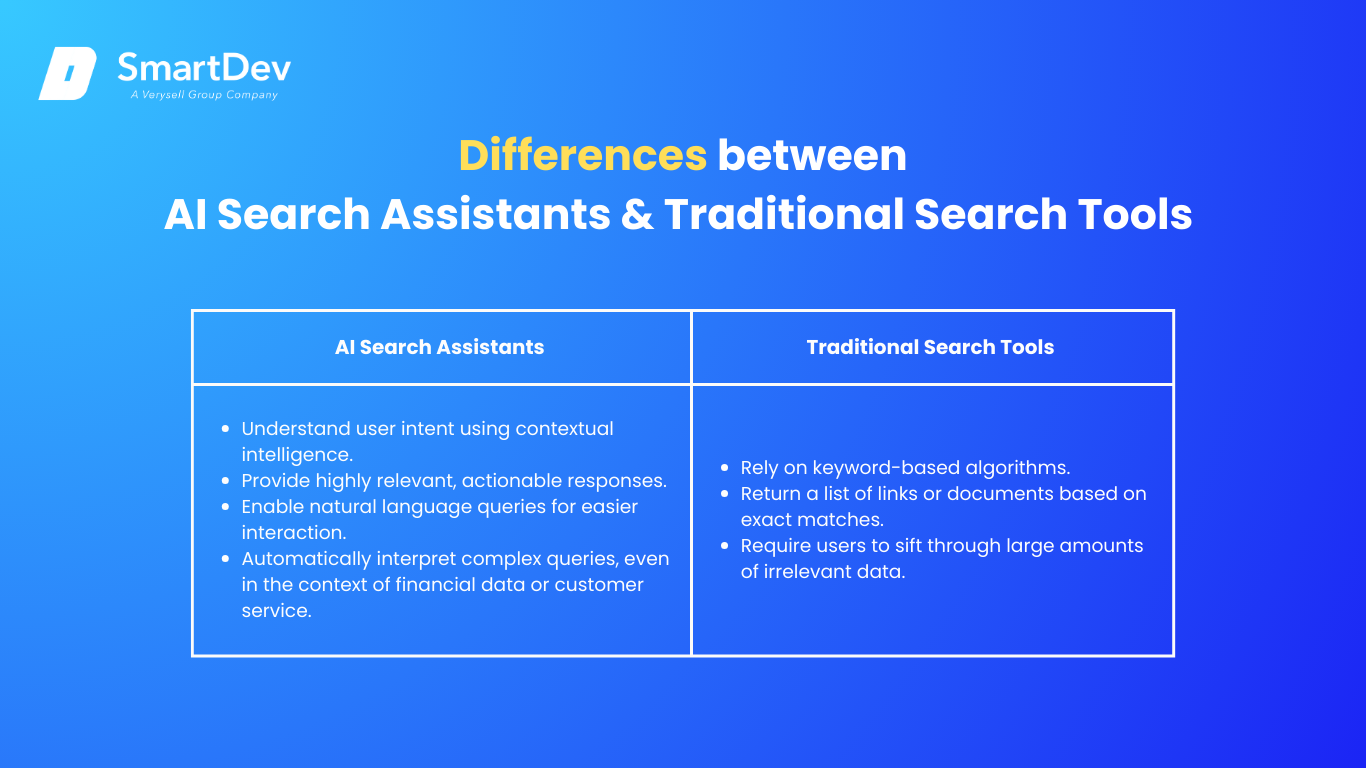

Key Differences Between AI Search Assistants and Traditional Search Tools

AI search assistants offer a significant advancement over traditional search tools, particularly in the realm of knowledge management in artificial intelligence. While traditional search engines rely on keyword-based algorithms that return a set of links or documents based on exact matches, AI-powered search assistants leverage contextual intelligence to understand the user’s intent and provide tailored, relevant results.

Key Differences:

Traditional Search Tools:

- Rely on keyword-based algorithms.

- Return a list of links or documents based on exact matches.

- Require users to sift through large amounts of irrelevant data.

AI Search Assistants:

- Understand user intent using contextual intelligence.

- Provide highly relevant, actionable responses.

- Enable natural language queries for easier interaction.

- Automatically interpret complex queries, even in the context of financial data or customer service.

For financial institutions, AI search assistants enhance automated data retrieval, streamline workflows, and provide faster, more accurate responses than traditional search tools, which are often limited to keyword-based matches.

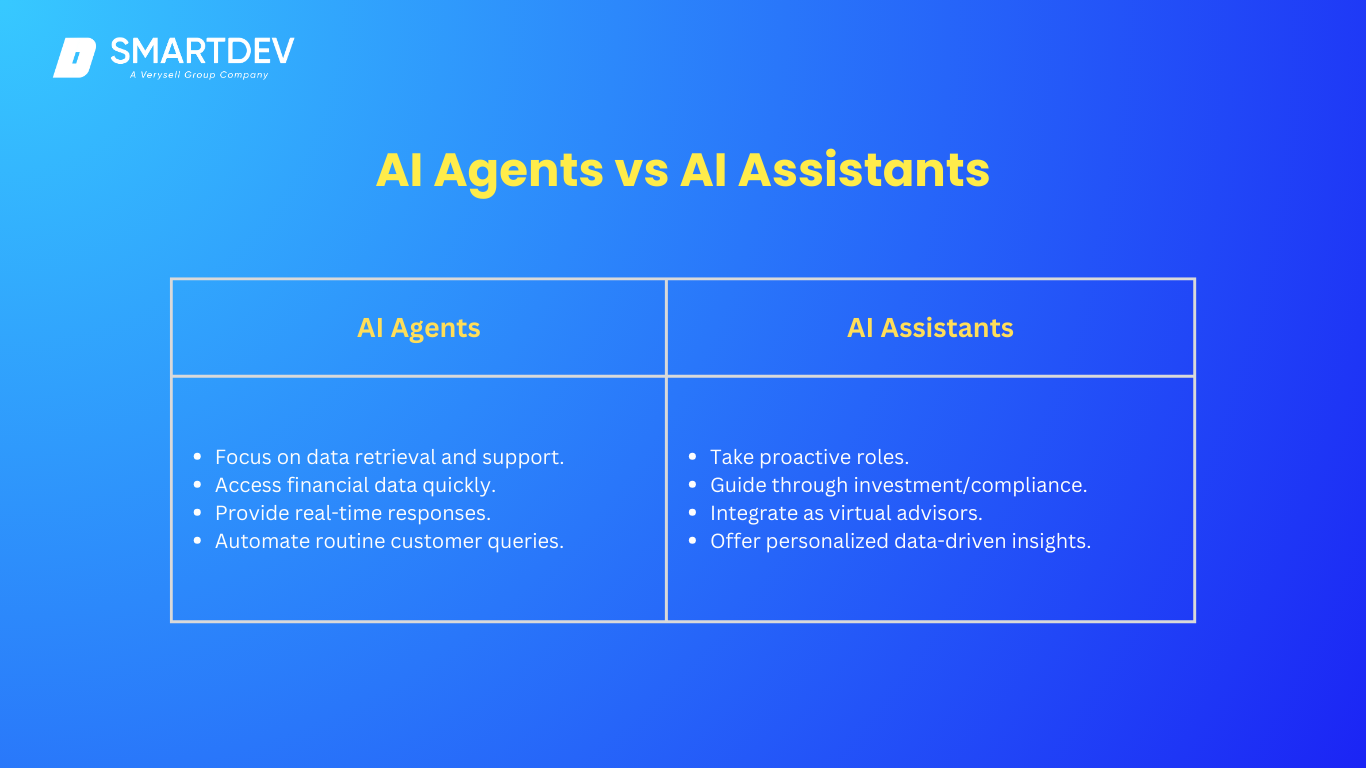

The Role of AI Agents vs. AI Assistants in Financial Services

While both AI agents and AI assistants are designed to enhance automation and efficiency, their roles within financial services differ.

AI Assistants:

- Focus on data retrieval, knowledge management, and decision support.

- Help users quickly access structured and unstructured financial data.

- Provide real-time responses, such as pulling up transaction histories or financial reports.

- Enhance customer service by automating routine queries, such as balance checks and transaction inquiries.

AI Agents:

- Take on proactive and autonomous roles.

- Guide users through complex processes, such as investment advice or regulatory compliance.

- Integrate with existing customer support systems to act as virtual financial advisors.

- Handle dynamic decision-making and provide personalized financial insights based on data.

Both AI agents and AI assistants play key roles in streamlining fintech workflows, but AI agents tend to focus more on interaction and decision-making, while AI assistants concentrate on efficient data retrieval and automation.

The Cost of Manual Search and Human Knowledge in Fintech Operations

The Cost of Manual Search and Human Knowledge in Fintech Operations

Before adopting AI-powered tools, many financial organizations rely heavily on manual search processes and human expertise to retrieve and manage data. While this approach might seem straightforward, it incurs significant hidden costs in terms of time, money, and accuracy. Let’s explore the impact of manual work on fintech operations.

-

Time Wasted in Manual Data Retrieval

In traditional financial operations, employees spend a considerable amount of time searching for information, cross-referencing documents, and manually inputting data into systems. Research shows that employees in data-intensive roles can spend up to 19% of their workweek simply searching for and gathering data across multiple platforms, spreadsheets, or file systems. This amounts to hundreds of hours annually per employee, leading to significant delays in decision-making and slower response times for customer inquiries.

-

High Financial Costs of Manual Data Entry

Manual data entry is not only time-consuming but also expensive. A 2025 analysis reveals that manual data entry costs U.S. companies an average of about $28,500 per employee annually, with much of this cost tied to labor-intensive tasks such as entering data from invoices, receipts, or transaction records into financial systems. Furthermore, inefficiency in document management can result in an additional 21% loss in overall output, costing companies an average of $19,732 per employee each year.

-

The Risk of Human Error in Financial Operations

Perhaps the most costly aspect of manual data work in fintech is the risk of human error. Despite best efforts, data entry errors are an inevitable part of manual processes. In fact, studies show that human error rates in data preparation can range from 0.55% to 3.6%, depending on the complexity of the task. In the highly regulated fintech industry, even a small error in financial reporting or compliance documentation can lead to significant consequences, such as fines, regulatory penalties, or reputational damage.

For example, errors in transaction records or financial statements could mislead decision-makers, leading to poor investment choices or inaccurate assessments of financial health. These mistakes can also result in costly corrective measures, which further drain financial resources and harm a company’s bottom line.

Enhancing Knowledge Management and Streamlining Fintech Workflows with AI

AI-powered solutions are revolutionizing knowledge management and optimizing workflows within the fintech industry. By integrating AI knowledge assistants, financial institutions can efficiently manage complex data, automate tasks, and gain real-time insights to improve operational efficiency.

The Importance of Centralized Knowledge Management Systems

Centralized systems are essential for organizing vast amounts of financial data in one accessible platform. Key benefits include:

- Real-time data access: Provides up-to-date information, essential for decision-making and responsiveness in a fast-paced industry.

- Improved collaboration: Enables seamless sharing of data across teams, ensuring that all stakeholders have access to accurate and timely information.

- Reduced data silos: Minimizes gaps in information and ensures consistency across various departments, improving accuracy and decision-making.

How AI Knowledge Assistants Manage Complex Financial Data

AI knowledge assistants enhance data management in several ways:

- Intelligent data extraction: AI extracts critical data from receipts, invoices, financial reports, and other documents, reducing manual input.

- Automated data processing: Handles large volumes of financial data, ensuring faster and more accurate results.

- Real-time updates: Ensures that financial data is always current, allowing organizations to make quick and informed decisions.

- Organizing and categorizing data: AI makes data easy to retrieve and analyze, improving efficiency across teams.

Integrating AI Across Financial Systems for Seamless Operations

AI can seamlessly integrate across various financial systems, improving workflow efficiency:

- Cross-platform integration: AI connects systems like CRM, accounting, and compliance, enabling smooth data flow.

- Reduced duplication: Eliminates redundant efforts by syncing data automatically across platforms.

- Improved data accuracy: AI ensures that all systems have consistent, up-to-date information, preventing errors.

- Real-time access to data: Provides immediate access to accurate data, allowing teams to act quickly and efficiently.

Building End-to-End AI-Powered Workflows for Financial Operations

AI automates entire financial workflows, enhancing both speed and accuracy. With automated transaction reconciliation, AI streamlines and improves the precision of financial transactions. AI-assisted financial reporting further reduces manual input, speeding up report generation while increasing accuracy. Additionally, AI handles automated compliance checks, ensuring that financial activities consistently meet regulatory standards without requiring manual oversight.

Furthermore, automated data retrieval allows teams to access critical financial information quickly, saving valuable time. By handling these routine tasks, AI enables employees to focus on more strategic and high-priority activities, ultimately improving operational efficiency and decision-making.

Discover how SmartDev helps fintech teams leverage AI knowledge assistants to streamline operations and reduce costs by validating use cases and aligning stakeholders before implementation.

SmartDev assists fintech teams in optimizing operations and cutting costs by validating AI knowledge and search assistant use cases and aligning key stakeholders.

Learn how companies accelerate AI chatbot initiatives in EU countries with SmartDev’s AI sprint, ensuring rapid deployment and reduced time to market.

Build Your AI Assistant With UsBenefits of AI Knowledge and Search Assistants

1. Enhanced Efficiency

AI search assistants automate routine tasks, allowing teams to focus on higher-value work that drives business growth. By automating processes such as data retrieval, AI reduces the time spent on manual tasks, improving overall workflow efficiency. Teams can access critical information much faster, resulting in quicker decision-making and better resource allocation.

2. Improved Accuracy

AI-powered systems excel at intelligent data extraction, especially from receipts and invoices, ensuring that financial data is accurate and reducing errors. By handling repetitive data entry tasks, AI minimizes human error, leading to more reliable financial reporting and stronger compliance. These accurate insights help in making better decisions and maintaining financial integrity.

3. Cost Savings

AI significantly reduces the need for manual labor by automating processes such as data entry and report generation. This cuts labor costs while increasing productivity. The AI search assistant cost is justified by the long-term savings and efficiency gains, as tasks that once required human intervention are now handled by intelligent systems, allowing employees to focus on strategic work.

4. Better Customer Experience

With real-time data access, AI search tools for finance can provide faster and more personalized customer support. AI can instantly retrieve relevant information, enabling quick and accurate responses to customer queries. This enhances the customer experience, improving satisfaction and fostering stronger client relationships.

5. Scalability and Flexibility

AI-powered solutions are highly scalable, meaning that as a financial institution grows, its AI capabilities can adapt to increased demands. Whether it’s handling more transactions, pulling data from additional systems, or supporting a growing customer base, AI systems can scale without a significant increase in costs, ensuring the business remains efficient even during periods of growth.

Challenges and Considerations for Implementing AI in Fintech

AI in fintech offers great benefits, but financial institutions face challenges in areas such as data security, integration, and team preparation. Addressing these hurdles is crucial for maximizing AI’s potential.

1. Overcoming Data Security and Privacy Challenges in AI Integration

1. Overcoming Data Security and Privacy Challenges in AI Integration

AI solutions like AI search assistants handle sensitive financial data, increasing the need for robust security measures. The average cost of a data breach in financial services is $5.72 million. Compliance with GDPR and CCPA is critical. AI search tools for finance must include encryption, secure data storage, and role-based access while ensuring real-time data access. Protecting data during intelligent data extraction is essential to prevent breaches.

2. Integrating AI Solutions Within Existing Fintech Ecosystems

Integrating AI into existing fintech systems is often difficult, especially with legacy systems. Over 60% of financial firms report challenges with system integration when adopting AI. AI-powered search assistants must integrate with platforms like CRM and compliance tools without disrupting operations. Ensuring smooth data flow through knowledge management in artificial intelligence is key for effective integration.

3. Training and Preparing Teams for AI Adoption in Financial Services

AI adoption requires training for staff to use new tools. 77% of financial institutions cite employee training as a barrier to AI adoption. Staff must understand how to leverage AI-assisted financial reporting and manage AI search assistant costs. Proper training helps teams maximize AI’s potential, enhancing efficiency and decision-making in financial operations.

How SmartDev Can Help FinTech Leverage AI Knowledge and Search Assistants

SmartDev offers AI-powered knowledge management solutions tailored for the fintech sector, enabling institutions to streamline operations, improve compliance, and deliver superior customer service. By incorporating advanced AI technology, financial firms can automate routine processes, gain real-time insights, and enhance decision-making.

SmartDev’s AI Knowledge Management Solutions for FinTech

SmartDev’s AI knowledge assistants provide a comprehensive solution for managing both structured and unstructured data. These systems use advanced entity recognition and intelligent data extraction to automatically process vast amounts of data, allowing for efficient query handling and ensuring accurate, real-time data access. The use of AI-powered search assistants enables fintech companies to efficiently navigate through large databases and retrieve critical financial information, significantly reducing manual labor and operational delays.

Streamlining Data Access and Improving Operational Efficiency

SmartDev’s AI solutions enable automated data retrieval, allowing fintech companies to quickly access important financial data such as transaction records, regulatory reports, and customer information. By integrating contextual intelligence and natural language querying, the AI assistants provide easy and fast access to complex financial data, improving operational efficiency. This technology reduces the time spent on manual searches, enhances decision-making, and ensures that teams have the right information at their fingertips.

Integrating AI with Existing Systems for Seamless Deployment

One of SmartDev’s core strengths is its ability to seamlessly integrate AI with existing fintech systems like CRM platforms and compliance tools. This integration ensures minimal disruption during deployment, allowing organizations to enhance their workflows without major system overhauls. SmartDev’s customizable AI solutions adapt to the unique needs of each business, ensuring scalability and flexibility as the company grows, making it easy for fintech firms to integrate AI-powered tools into their operations.

Conclusion

The integration of AI into the fintech industry offers a multitude of benefits, from enhancing operational efficiency to improving accuracy and customer satisfaction. However, the challenges of data security, system integration, and employee training cannot be overlooked. By addressing these issues, financial institutions can unlock the full potential of AI, driving innovation and maintaining a competitive edge in a fast-evolving market.

SmartDev’s AI-powered solutions can help financial organizations overcome these challenges, providing seamless integration, real-time data access, and intelligent data extraction tools. As AI continues to reshape the future of fintech, staying ahead of the curve requires not only the right technology but also a commitment to ongoing training and adaptation.

Ready to leverage AI to optimize your fintech operations?

Contact SmartDev today to explore how our AI knowledge and search assistants can transform your business and help you achieve greater efficiency, security, and growth.

The Cost of Manual Search and Human Knowledge in Fintech Operations

The Cost of Manual Search and Human Knowledge in Fintech Operations

1. Overcoming Data Security and Privacy Challenges in AI Integration

1. Overcoming Data Security and Privacy Challenges in AI Integration