Introduction

Investment managers today navigate complex challenges – data overload, volatile markets, and rising client expectations for personalization and agility. Artificial Intelligence (AI) is stepping in as a transformative solution, automating insights, optimizing portfolios, and enabling dynamic decision‑making. This comprehensive guide explores how AI is reshaping investment management by delivering tangible improvements and strategic advantages.

What is AI and Why Does It Matter in Investment Management?

Definition of AI and Its Core Technologies

AI refers to computer systems designed to replicate human cognitive functions such as learning, reasoning, decision-making, and pattern recognition. Core AI technologies, which are machine learning, natural language processing (NLP), and computer vision, enable systems to process massive datasets, extract insights, and improve autonomously over time.

In investment management, AI is used to analyze financial data, model risk, automate portfolio decisions, and detect market opportunities. From robo-advisors managing retail portfolios to machine learning algorithms predicting asset price movements, AI transforms traditional investment workflows into data-driven, responsive systems. This evolution is essential as firms contend with increasing data complexity and client demands for personalized, transparent strategies.

The Growing Role of AI in Transforming Investment Management

AI is redefining how investment research and strategy development occur. Leading firms use NLP to digest earnings reports, regulatory filings, and market sentiment in real time, accelerating idea generation and improving alpha capture. Deep learning models also detect nuanced relationships between macroeconomic variables and asset prices, enabling more informed investment decisions.

Portfolio management is becoming more agile through AI-powered optimization tools. These systems dynamically adjust asset allocations in response to market conditions, improving risk-adjusted returns. Platforms like BlackRock’s Aladdin simulate complex market scenarios to guide rebalancing and reduce portfolio drawdowns during volatility.

Operationally, AI streamlines compliance, client onboarding, and reporting. UBS, for instance, uses AI to automate know-your-customer (KYC) processes, significantly reducing time spent on administrative tasks. This shift allows investment professionals to focus more on value-added analysis and client engagement.

Key Statistics and Trends in AI Adoption in Investment Management

AI adoption in investment management is accelerating. A 2024 Mercer survey of 150 asset managers reveals that 91% are either currently using (54%) or planning to use (37%) AI in asset-class research and portfolio construction, reflecting growing confidence in AI’s ability to enhance decision-making and drive returns.

AI-enabled systems are delivering significant efficiency gains. Generative AI is streamlining compliance processes, enabling firms to interpret complex regulatory requirements and flag documentation gaps in hours, significantly faster than traditional methods. BlackRock’s Asimov system, a virtual investment analyst, provides real-time, data-driven insights into portfolio risks and exposures, enhancing risk management and decision-making.

Market projections underscore AI’s transformative role. According to Grand View Research, the global AI in asset management market is expected to grow from $3.68 billion in 2023 to $17.01 billion by 2030, at a CAGR of 24.5%. This growth is fueled by increasing reliance on AI for predictive analytics, automated client reporting, and dynamic portfolio rebalancing, which are becoming standard tools across the industry.

Business Benefits of AI in Investment Management

AI delivers tangible value by solving major challenges in investment management—such as information overload, manual portfolio adjustments, and inconsistent risk evaluation. Below are five core business benefits that AI brings to modern investment firms:

1. Accelerated Research and Idea Generation

AI automates the extraction of insights from earnings calls, filings, and market news, enabling analysts to surface investment ideas much faster. NLP tools parse unstructured data with high accuracy, revealing sentiment shifts and key developments across industries. This rapid synthesis of information reduces time-to-decision and enhances the agility of research teams.

By replacing manual data review with automated analysis, firms gain earlier visibility into potential opportunities. For example, AllianceBernstein used AI to analyze healthcare regulation, cutting research timelines from months to hours. Such efficiency allows firms to allocate more time toward validating strategies and less on information gathering.

2. Intelligent Portfolio Optimization

AI models dynamically adjust portfolios by continuously analyzing historical data, economic signals, and market trends. These models consider complex interactions among assets, improving allocation strategies beyond what traditional methods offer. This results in more responsive and risk-adjusted portfolio management.

Reinforcement learning techniques further enable real-time rebalancing based on evolving market states. Unlike static models, these AI systems learn from new data and optimize actions accordingly. This helps protect portfolios during volatility and enhances long-term performance consistency.

3. Advanced Risk Management

AI enhances risk oversight by identifying non-obvious correlations and emerging threats that traditional models may miss. Tools like BlackRock’s Aladdin simulate stress scenarios, from geopolitical shocks, interest rate shifts to test portfolio resilience. This enables managers to proactively rebalance portfolios before risks materialize.

Real-time sentiment monitoring and news analytics also give firms an edge in anticipating market disruptions. Generative AI models can process headlines and financial chatter to flag warning signals instantly. These capabilities improve compliance, reduce drawdowns, and support better-informed decisions.

4. Operational Efficiency and Cost Reduction

AI significantly cuts back-office workloads by automating client onboarding, documentation, and compliance checks. UBS, for example, uses AI to streamline its KYC processes, saving time and minimizing errors. Automation reduces friction in administrative tasks and accelerates client activation.

Cost savings are equally critical, particularly as fee pressures rise across the industry. By lowering dependence on manual operations, firms reduce overhead without compromising quality. This frees up human capital to focus on complex, high-value tasks like advisory and strategic planning.

5. Scalable and Personalized Client Experiences

AI powers digital tools that deliver customized investment insights and real-time portfolio updates to individual clients. Robo-advisors use client preferences and risk profiles to generate optimized strategies autonomously. This enables scalable personalization, delivering white-glove experiences at a fraction of traditional costs.

For high-net-worth clients, AI assists wealth managers by generating tailored reports and recommendations instantly. These tools help maintain high service standards while managing larger client books efficiently. Ultimately, this improves client satisfaction, retention, and long-term firm loyalty.

Challenges Facing AI Adoption in Investment Management

While AI holds immense potential, firms face several barriers to successful implementation. These challenges stem from structural issues, regulatory complexity, and the nature of AI technologies themselves.

1. Data Fragmentation and Quality Issues

AI systems require clean, structured, and timely data—but many firms still rely on siloed databases and legacy systems. Inconsistent formatting, missing values, and duplicated records can distort AI predictions and reduce model accuracy. Without a solid data foundation, even advanced algorithms produce unreliable outputs.

Maintaining high-quality data involves more than just technology; it demands continuous oversight and cross-departmental coordination. Investment firms often lack centralized data governance policies, making integration efforts difficult. As a result, data issues can delay AI adoption and limit scalability across departments.

2. Regulatory Uncertainty and Compliance Risk

AI’s “black box” nature makes it difficult to explain decisions, a major issue in tightly regulated environments. Regulators increasingly demand transparency in how investment decisions are made, particularly when algorithms influence client portfolios. This puts pressure on firms to develop interpretable AI systems, which can be technically limiting.

Compliance teams may struggle to audit AI models or ensure they meet fiduciary standards. Integrating AI without compromising compliance often requires custom governance frameworks and extensive validation. These added complexities slow down deployment and increase operational risk if not managed correctly.

3. Over-Reliance and Loss of Human Judgment

As firms adopt AI tools for forecasting and decision-making, there’s a risk of over-reliance on automated outputs. While AI can process data at scale, it lacks the contextual understanding and intuition that experienced managers provide. Blind trust in models may lead to errors during atypical or black-swan market events.

Investment management still requires human oversight to assess qualitative factors—such as geopolitical sentiment or company leadership. AI lacks the ability to weigh moral, ethical, or nuanced judgments. Overdependence can undermine portfolio performance and erode accountability in investment processes.

4. Talent and Infrastructure Gaps

Developing, training, and maintaining AI systems requires specialized talent in data science, machine learning, and quantitative finance. However, the demand for such expertise far exceeds the current supply, especially in traditional finance firms. This talent shortage slows innovation and increases the cost of building in-house solutions.

In addition, many firms lack the high-performance computing infrastructure needed to run complex AI models. Cloud migration, data pipelines, and secure environments all require major investment. For smaller asset managers, these entry costs can be prohibitive and deter AI adoption altogether.

5. Strategic Misalignment and Unrealistic Expectations

Firms sometimes pursue AI for its buzz without aligning use cases to actual business needs. Misalignment between AI capabilities and investment goals can result in wasted resources and underwhelming outcomes. AI should be seen as a tool to enhance existing strategies.

Unrealistic expectations also contribute to disappointment. Executives may expect instant results, overlooking the time needed for model training, integration, and testing. Without clear metrics and phased implementation, AI projects risk being deprioritized or abandoned mid-course.

Specific Applications of AI in Investment Management

This comprehensive article explores six impactful AI applications in the investment management sector, supported by real-world case studies and cutting-edge innovations. We’ll examine how AI is transforming the financial landscape through speed, efficiency, and predictive intelligence, empowering fund managers, analysts, and institutions with measurable performance advantages.

1. AI-Driven Algorithmic Trading

Algorithmic trading, powered by AI, is revolutionizing how trades are executed across global markets. These systems leverage machine learning to analyze massive datasets like pricing, volume, volatility, and news sentiment to identify optimal trading opportunities in milliseconds. The technology addresses key industry challenges like latency, inefficiency, and the need for continuous 24/7 market responsiveness.

The core methods include supervised learning and deep reinforcement learning, which train trading algorithms to predict price movements and execute trades autonomously. These AI models are fed with both structured (e.g., tick data, order books) and unstructured data (e.g., financial news) and integrate directly with electronic trading platforms through APIs. This integration enables firms to reduce trading costs, improve execution quality, and gain competitive advantages in high-frequency trading environments.

A notable example is Renaissance Technologies, one of the world’s most successful quant hedge funds, which has long employed AI and machine learning in its trading models. Their proprietary Medallion Fund uses advanced pattern recognition and probabilistic modeling to manage trades—generating average annual returns above 60% before fees, according to reports. While their specific technologies are secretive, the firm is often cited as a pioneer of AI in algorithmic investment.

2. AI for Portfolio Optimization and Dynamic Asset Allocation

AI is transforming portfolio management by enabling dynamic asset allocation based on real-time market conditions and investor-specific goals. Traditional portfolio models rely on static assumptions, but AI systems use machine learning to continuously adapt asset weights, risk profiles, and exposure levels. This helps solve the industry problem of maintaining optimal asset mix amid volatile and complex markets.

The core technologies include reinforcement learning and advanced statistical modeling that learn to optimize portfolios for objectives like risk-adjusted return. These systems ingest diverse data and operate within portfolio management platforms. The strategic value lies in the AI’s ability to reduce human bias, react faster to changes, and improve long-term portfolio performance.

An example is Man Group, one of the world’s largest publicly traded hedge fund firms, which applies AI-driven optimization in its AHL unit. Using tools like neural networks and reinforcement learning, AHL dynamically adjusts portfolio strategies across asset classes. This contributed to a multi-year performance trend that consistently beat traditional benchmarks while maintaining lower volatility.

3. Natural Language Processing for Market Sentiment Analysis

In investment management, unstructured data is abundant—news articles, earnings call transcripts, social media, and regulatory filings. AI systems using NLP extract actionable sentiment from this data, enabling firms to anticipate market movements and assess company outlooks. This addresses the challenge of processing vast qualitative information at scale and speed.

NLP techniques like named entity recognition, topic modeling, and sentiment scoring allow AI to assess tone and relevance across thousands of documents in real time. These systems integrate into analyst dashboards and trading platforms, supplementing traditional metrics with a sentiment-informed perspective. The strategic benefit includes enhanced forecasting accuracy, faster response times, and reduced reliance on manual research.

A leading example is JPMorgan Chase, which uses AI-based sentiment analysis tools to parse earnings calls and media reports. The firm’s proprietary algorithms assign sentiment scores to companies, which are then factored into trading strategies. This technology has improved early signal detection and risk management in their equity and credit portfolios.

4. Robo-Advisors for Scalable, Personalized Investing

Robo-advisors are AI-powered platforms that provide automated investment advice, offering customized portfolios based on individual goals, timelines, and risk tolerance. This application addresses a major gap in the industry, providing low-cost, personalized investment solutions to retail and mass-affluent clients without requiring human advisors.

The AI behind robo-advisors typically uses decision trees, optimization algorithms, and customer segmentation models to assign portfolios and manage rebalancing. Data inputs include investor profiles, market data, and risk-return frameworks like Modern Portfolio Theory. These platforms integrate digital onboarding tools, CRM systems, and custodial services to offer a seamless experience.

One standout is Betterment, a pioneer in the robo-advisor space, which uses AI to provide tax-efficient investing and personalized financial planning. Its platform automatically rebalances portfolios and applies tax-loss harvesting techniques, leading to improved after-tax returns. As of 2025, Betterment manages over $45 billion in assets, driven by scalable and accessible AI infrastructure.

5. AI in Risk Management and Regulatory Compliance

AI plays a critical role in modernizing compliance processes and risk analytics within investment management. Regulatory obligations, fraud detection, and operational risk identification are now being managed through intelligent systems that learn from historical data and ongoing transactions. This addresses the growing complexity of compliance requirements and the limitations of manual oversight.

Machine learning models are used for anomaly detection, fraud pattern recognition, and predictive risk scoring. These tools analyze communication logs, trading patterns, and internal reports to flag suspicious behavior or policy violations. AI systems also help generate real-time regulatory reports and streamline audit trails. Their operational value lies in reducing compliance costs, minimizing errors, and enabling proactive risk detection.

A real-world example is Goldman Sachs, which uses machine learning to monitor employee communications and flag potential breaches of trading or ethical policies. The firm also applies AI to assess counterparty risks and streamline compliance documentation. This has resulted in faster risk identification and substantial savings in legal and audit costs.

6. Generative AI for Research, Reporting, and Communication

Generative AI is emerging as a powerful tool for investment research, client reporting, and internal documentation. These AI models can draft research summaries, earnings analysis, and investment letters, dramatically improving productivity and content consistency. This addresses time constraints and repetitive work often faced by analysts and fund managers.

Generative models such as GPT-based architectures are trained on financial corpora and integrate with research platforms to automate content generation. They also enhance client engagement by delivering personalized portfolio reports and tailored communication in natural language. Strategic benefits include time savings, higher output, and improved communication accuracy, but firms must address oversight and hallucination risks.

UBS is a prime example, having deployed its in-house generative AI assistant “Red” to support over 30,000 employees across the organization. Red helps with client onboarding, internal queries, and document drafting, producing over one million AI-generated prompts each month. UBS reports a significant increase in productivity and better client turnaround times.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in Investment Management

AI’s transformative potential in investment management becomes most evident through real-world implementation. The following case studies illustrate how top firms are leveraging AI across portfolio management, research automation, and personalized advisory, delivering measurable performance gains, operational efficiency, and investor satisfaction.

Real-World Case Studies

1. Minotaur Capital: AI for Alpha-Driven Fund Strategy

Minotaur Capital faced the ongoing challenge of identifying high-potential investment opportunities across volatile global markets. With thousands of financial articles, economic reports, and sentiment data to analyze daily, human analysts were overwhelmed and unable to extract signals fast enough. The firm needed an edge in both speed and insight generation to maintain alpha in competitive fund performance.

To solve this, Minotaur developed an AI platform called Taurient, which processes over 35,000 articles per week using NLP and sentiment analysis to identify emerging themes and strategic ideas. These AI-generated signals are then vetted by human portfolio managers to refine trades and macro allocations. This hybrid human-AI workflow allows Minotaur to stay ahead of market trends with precision and agility.

The results speak volumes: The Minotaur Global Opportunities Fund delivered a 23.5% return year-to-date, outperforming the MSCI ACWI index benchmark of 17.4%. The fund also reported a 60% reduction in research cycle time, allowing for faster execution and higher conviction in trades. Taurient has become a core differentiator in their strategy.

2. AllianceBernstein: Accelerated Fundamental Research

AllianceBernstein, a global investment management firm, was grappling with slow and resource-intensive research cycles that limited timely decision-making. Analysts often took weeks or months to thoroughly review legislation, sector dynamics, and company reports, hindering their ability to act quickly on fast-moving developments. The firm needed to accelerate its research capability without compromising analytical rigor.

They deployed an AI platform capable of scanning and summarizing regulatory texts, policy documents, and market reports using advanced NLP and summarization models. These AI tools now augment human researchers by providing real-time insights and visual dashboards to evaluate impact and relevance. Analysts can now simulate policy effects, evaluate sector exposure, and extract company-specific risks much faster.

This transformation has resulted in research cycle times being cut by over 70%, significantly improving time-to-market for investment theses. Portfolio teams report increased conviction in decisions and greater agility in capturing opportunities, providing a distinct edge over slower-moving competitors.

3. BlackRock: Intelligent AI Agents for Portfolio Insights

BlackRock, the world’s largest asset manager, sought a more intelligent system for analyzing real-time financial data, regulatory shifts, and portfolio impacts. Traditional dashboards and data warehouses provided a retrospective view but lacked contextual insight and forward-looking reasoning. BlackRock needed AI-driven agents that could actively synthesize information and deliver autonomous insights.

To address this, BlackRock launched “Asimov,” an AI-based agent designed to read, analyze, and generate actionable insights from internal documents, external news, and regulatory updates. Asimov is integrated into the firm’s Aladdin platform and serves as a virtual co-pilot for portfolio managers, suggesting risk alerts, market updates, and strategy adjustments. It uses advanced large language models and retrieval-based reasoning for precision.

This AI deployment has resulted in improved decision-making efficiency and faster reactions to global market events. Portfolio managers report greater situational awareness, and BlackRock credits Asimov with enhancing responsiveness to geopolitical developments and client concerns, reinforcing its leadership in AI-powered asset management.

Innovative AI Solutions

AI-Driven Innovations Transforming Investment Management

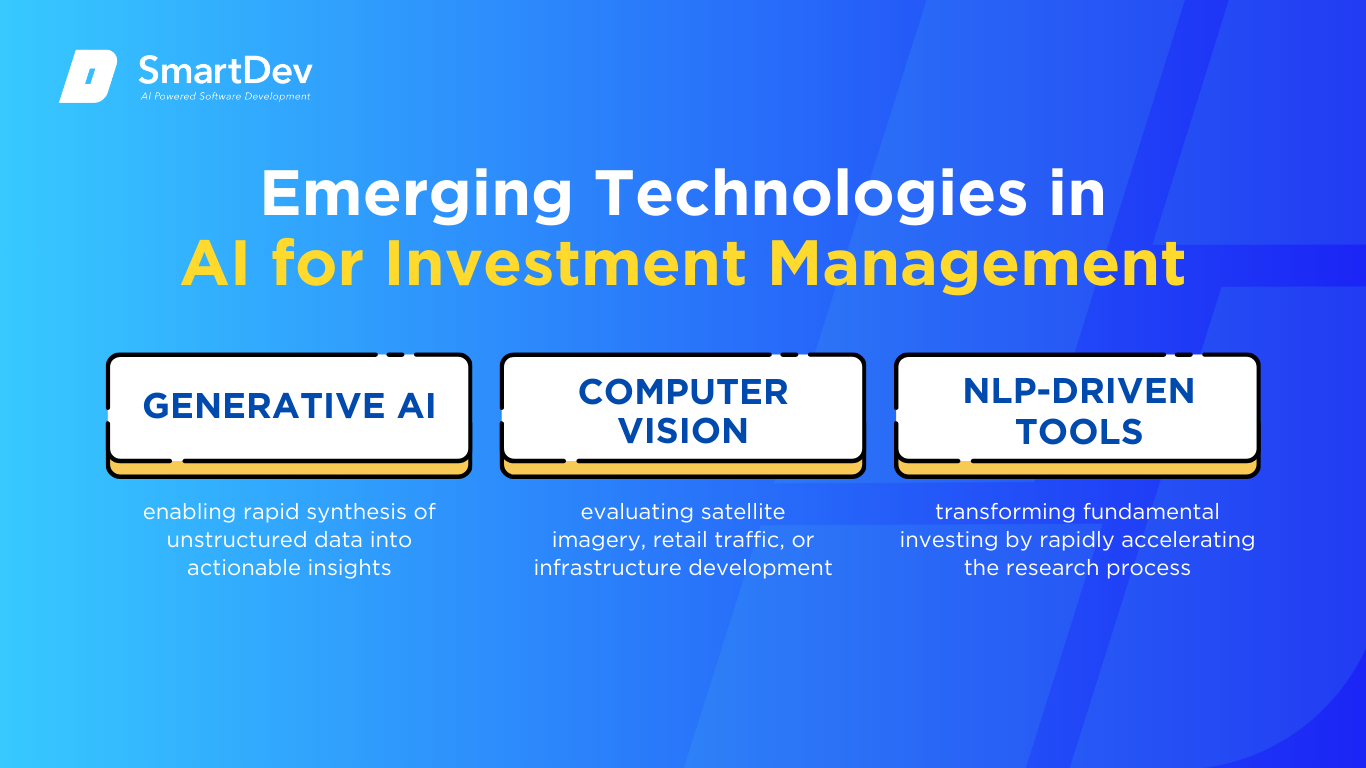

Emerging Technologies in AI for Investment Management

Generative AI is revolutionizing the investment management landscape by enabling rapid synthesis of unstructured data into actionable insights. Fund managers can now leverage these tools to digest regulatory filings, earnings transcripts, geopolitical news, and ESG reports in minutes, analyzing what would take human analysts days or even weeks.

Computer vision is gaining traction in alternative data analysis within investment strategies. Firms are using AI-powered visual analytics to evaluate satellite imagery, retail traffic, or infrastructure development to inform macroeconomic forecasts and equity positions. This edge is particularly valuable for hedge funds and quant strategies aiming to extract alpha from overlooked data sources.

AI assistants and NLP-driven tools are transforming fundamental investing by rapidly accelerating the research process. At firms like JPMorgan and AllianceBernstein, AI helps identify legislative developments or supply chain risks that could impact holdings. These tools allow analysts to ask complex questions and receive concise, investment-focused responses, speeding up due diligence and reducing research costs.

AI’s Role in Sustainability Efforts

AI is helping investment firms embed sustainability deeper into their decision-making. Through predictive analytics, asset managers can evaluate ESG risks before they materialize, tracking environmental signals, supply chain instability, or social sentiment that may impact asset valuation. This proactive monitoring helps firms steer portfolios toward sustainable, long-term growth while minimizing reputational risk.

Sustainability reporting is also benefiting from AI. Firms are using machine learning to automate ESG disclosures, benchmark company performance, and ensure compliance with emerging global standards. For example, Clarity AI helps investors assess the real-world impact of their portfolios by analyzing emissions, water usage, and labor practices using thousands of data points, enabling more informed, responsible investing.

How to Implement AI in Consumer Goods

Step-by-step guide for adopting AI in investment management: readiness, data, tools, piloting, and training.

Step 1: Assessing Readiness for AI Adoption

Before diving into AI, investment firms need to evaluate where and how AI can create the most value. This could be in areas such as fundamental research, risk management, trade execution, or ESG analytics. A clear understanding of operational bottlenecks and investment challenges will help define AI’s role in your strategy.

Equally important is assessing internal infrastructure and AI maturity. Does your firm have the right data systems, APIs, or cloud architecture to support AI tools? Are compliance teams ready to audit machine-generated decisions? These questions help ensure your AI plans are grounded in realistic capabilities and that future integration won’t be hampered by legacy tech or organizational resistance.

Step 2: Building a Strong Data Foundation

Data is the currency of AI and in investment management, the stakes are even higher. To enable effective AI use, firms must build a well-structured, centralized data ecosystem that pulls from internal and external sources. This includes real-time market data, analyst reports, ESG databases, alternative datasets, and even structured news feeds.

Data accuracy, consistency, and labeling are non-negotiables. Investment firms need data pipelines that clean, validate, and standardize inputs, reducing bias and improving model reliability. Without a solid foundation, even the most advanced AI tools will produce flawed insights. Once in place, this data framework enables deeper analysis, faster reactions to market shifts, and scalable investment strategies.

Step 3: Choosing the Right Tools and Vendors

Choosing the right AI solutions means balancing technical capabilities with industry relevance. Investment managers should evaluate platforms that support everything from generative research assistants to quantitative modeling and portfolio rebalancing. Tools should offer transparency, integrate smoothly with existing workflows, and comply with regulatory standards.

It’s also important to partner with vendors that understand the financial space. Whether it’s a global firm leveraging proprietary tools, or startups offering predictive analytics and NLP-based sentiment scoring, you need partners that bring not just tech, but domain expertise. Vendor reliability, support infrastructure, and a strong track record should weigh heavily in the decision.

Step 4: Pilot Testing and Scaling Up

Instead of going all-in, firms should start with small pilot programs targeting specific use cases. This might involve using generative AI to summarize quarterly earnings reports or applying machine learning models to flag unusual trading behavior. These pilots serve as a litmus test for usability, integration, and real business value—without risking core systems or strategies.

Once proven successful, these solutions can be expanded across departments—moving from research teams to portfolio management and client advisory services. This phased approach reduces implementation risk, improves user adoption, and ensures the firm remains agile in adjusting AI initiatives based on real-world feedback.

Step 5: Training Teams for Successful Implementation

Even the most advanced AI systems need human judgment to steer them. Training is critical, not just for using AI tools, but for understanding how to interpret their outputs. Investment professionals should be educated on model logic, potential biases, and when to rely on or override machine-generated insights.

Creating cross-functional teams with analysts, data scientists, and compliance officers helps foster a culture of collaboration. Position AI as a strategic assistant, not a replacement. This mindset boosts employee confidence and accelerates adoption. As AI continues to reshape workflows, firms that invest in upskilling will be best positioned to lead the next era of intelligent investing.

Measuring the ROI of AI i Investment Management

Key Metrics to Track Success

Measuring the ROI of AI in investment management requires a blend of financial and operational metrics. One of the most impactful indicators is productivity improvement, particularly how AI accelerates research and decision-making. For instance, analysts using AI-powered summarization tools can process earnings calls, legislation, and macroeconomic reports in minutes instead of hours, freeing up time for strategic tasks like modeling and scenario planning.

Cost savings is another key ROI lever. AI reduces labor-intensive manual analysis, minimizes compliance errors, and automates repetitive trading or reconciliation tasks. Additionally, investment firms monitor alpha generation, the extra return attributable to AI-driven insights and compare it against traditional benchmarks. Client retention, portfolio performance, and reduced drawdowns during volatile markets also serve as tangible metrics of AI’s effectiveness in enhancing long-term investment outcomes.

Case Studies Demonstrating ROI

Several investment firms are already seeing measurable returns from AI. At AllianceBernstein, analysts using generative AI reduced multi-week research timelines to just a few hours, allowing faster capital deployment and improved positioning around emerging events. UBS piloted an AI assistant to support wealth managers in client onboarding and due diligence, cutting administrative time and enabling advisors to focus on high-value interactions.

Minotaur Capital, a boutique fund in Australia, uses its AI platform Taurient to scan over 35,000 articles weekly, helping identify unique investment ideas. The result? A 23.5% YTD return well above the 17.4% MSCI ACWI index. These real-world applications showcase how AI is not just a theoretical tool; it’s already boosting profitability, agility, and efficiency across the financial sector.

Common Pitfalls and How to Avoid Them

Despite AI’s benefits, there are common traps that can undermine ROI. One major issue is data fragmentation. Many firms have siloed or inconsistent data, leading to inaccurate predictions or model failures. To avoid this, investment managers must centralize data, enforce quality standards, and adopt tools that ensure consistent data labeling and interpretation across systems.

Another risk is overlooking the importance of human oversight. While AI can flag anomalies or generate investment suggestions, it lacks the nuance and market context that experienced analysts bring. Firms that over-automate or ignore regulatory guidelines may face compliance issues or make poor investment decisions.

Training is also often underemphasized, staff need to understand how AI works, where its limits lie, and how to use its insights effectively. Mitigating these pitfalls requires a balanced strategy: strong data governance, ongoing education, and a culture that blends technological efficiency with human judgment.

Future Trends of AI in Investment Management

Predictions for the Next Decade

Over the next decade, AI will become an indispensable force in the evolution of investment management. One of the most transformative trends will be the rise of autonomous investment agents, AI systems that can interpret global events, rebalance portfolios, and even execute trades in near real-time without human prompting. These agents will combine reinforcement learning with deep domain knowledge, enabling more adaptive and resilient investment strategies.

At the same time, personalization in wealth management will reach new levels. AI will not only analyze client preferences but predict life events, risk appetite shifts, and behavioral triggers, allowing firms to craft dynamic, hyper-personalized portfolios.

NLP will also mature, giving rise to AI assistants that communicate in human-like dialogue, guiding investors with contextualized advice. Additionally, quantum computing and edge AI could begin to influence risk modeling and ultra-fast analytics, opening the door to previously unreachable investment insights.

How Businesses Can Stay Ahead of the Curve

To stay ahead, investment firms must view AI not as a tool, but as a long-term strategic differentiator. This means continuously investing in AI R&D, exploring next-gen technologies like agentic AI, predictive behavioral models, and synthetic data training environments. Firms should also embrace hybrid infrastructures, combining on-prem systems with cloud-native AI platforms to support scalability, data security, and high-frequency analytics.

Equally important is cultivating a forward-thinking culture. Firms need to empower cross-disciplinary teams, combining quants, technologists, and investment professionals, to collaborate on AI strategy. Continuous learning, ethical AI governance, and staying aligned with global regulations will be essential. By fostering innovation and remaining agile, investment firms can future-proof their operations and deliver exceptional outcomes to clients in an increasingly digital, data-driven financial world.

Conclusion

Key Takeaways

AI is fundamentally reshaping investment management by automating research, enhancing portfolio strategies, and improving operational efficiency. Tools like generative AI, computer vision, and advanced predictive analytics are empowering firms to identify alpha-generating signals, streamline compliance, and personalize client engagement at scale. Whether it’s reducing time-to-insight or enabling real-time risk management, AI is redefining what’s possible across every tier of the investment lifecycle.

Importantly, AI is also influencing responsible investing. With its ability to process massive ESG datasets and flag hidden sustainability risks, AI helps firms align portfolios with values and compliance standards. Real-world success stories, from Minotaur Capital’s market-beating returns to UBS’s AI-augmented wealth teams, demonstrate that thoughtful AI adoption delivers measurable financial and strategic gains.

Moving Forward: A Strategic Approach to AI in Investment Management

AI is no longer just an innovation; it’s a competitive necessity in investment management. To fully unlock its value, firms must prioritize clean data, scalable infrastructure, and continuous staff education. By building AI fluency across teams and aligning investments with cutting-edge tools, firms can drive long-term growth, resilience, and agility.

At SmartDev, we collaborate with investment leaders to create tailored AI-powered solutions that streamline operations, enhance portfolio performance, and deliver personalized client experiences. Whether you’re automating research, optimizing trading strategies, or integrating ESG intelligence, our team is ready to help you lead the next era of intelligent investing.

Reach out today to discover how we can help your firm embrace the future of AI in investment management, securely, strategically, and successfully. Let’s shape a smarter financial future together.

—

References:

- Artificial Intelligence in Asset Management Market | Grand View Research

- Morgan Stanley & Oliver Wyman: Wealth & Asset Management 2023 GenAI Report

- How AI Could Reshape the Economics of the Asset Management Industry | McKinsey

- AI in Investment Management: Global Survey | Mercer

- Billionaire Robots: Machine Learning at Renaissance Technologies | Harvard Digital Innovation

- AI Investing Insights | BlackRock

- AI-Driven Spending Boom Is No Dot-Com Bust for Investors | AllianceBernstein

- UBS AI Strategy: Analysis of Dominance in Finance | Klover.ai

- Artificial Intelligence at Goldman Sachs | Emerj

- AI for Payments: Efficiency and Fraud Reduction | JPMorgan

- Man Group Moves into Machine Learning | CNBC